This is an in-depth guide on how to calculate Equity Ratio with detailed analysis, interpretation, and example. You will learn how to utilize this ratio's formula to examine a company's current debt situation by looking at its equity.

Definition - What is Equity Ratio?

All of a company’s assets are the result of shareholder equity, loans from creditors, or a combination of both.

The equity ratio, or shareholder’s equity ratio, is a simple calculation that can show you how much of a company’s assets are funded by owner shares.

When you evaluate a business as a potential investment, it’s important to find out as much as possible about its debt situation and its financial sustainability over the long-term.

This powerful ratio can provide you with information in both of these areas.

Because this ratio measures investor commitment to a company in the form of equity invested in assets, it also inversely demonstrates the amount of those assets that are supported and financed by debt.

The lower the ratio value is; the more debt a company has used to fund its assets.

In terms of sustainability, the more capable a company is of servicing its debt load over the long run, the more financially stable it is.

The higher the ratio value, the more solvent a company is considered to be, since shareholder-owned assets are in excess of the firm’s liabilities.

More...

Formula

To calculate the shareholder’s equity ratio for a given company, you would use the following formula:

Shareholders' Capital Ratio = Total Shareholders' Equity / Total Assets

In this ratio, the word “total” means exactly that, and ALL assets and equity reported on a company’s balance sheet must be included.

Read also: Time Interest Earned - Formula, Example & Analysis

Equity Ratio Calculator

Example

Okay now let's dive into a quick example so you can understand clearly how to find this ratio.

As a potential investor, you’d like to further investigate Company K’s debt situation and financial sustainability by comparing its total assets with its shareholder equity.

Using Company K’s balance sheet as a reference, you come up with the following information:

- Total Assets = $1,000,000

- Total Liabilities = $250,000

- Total Shareholder's Equity = $750,000

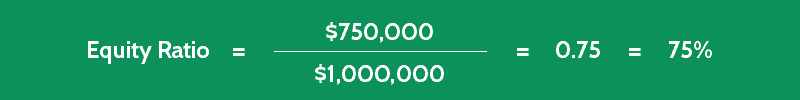

Now you can calculate Company K’s stockholders' equity ratio value by plugging these figures into the formula, as follows:

This result shows you that 75% of Company K’s assets are financed by shareholder equity, while only 25% are attributed to funding from debt.

This means that if Company K were to sell all of its assets to pay off its liabilities, investors would retain ownership of ¾ of the company’s resources.

Interpretation & Analysis

The closer to 100% a firm’s shareholders' equity ratio is, the closer it is to financing all of its assets with shareholder equity.

As always, your interpretation of how high or low an acceptable shareholders' capital ratio value is for a specific company will hinge on other available information.

Comparing results with industry benchmarks is extremely important, since these dictate what level of equity to assets is considered standard for a particular type of business.

So what is a good equity ratio for a company?

While a higher ratio value is generally considered to be a good thing, that doesn’t necessarily mean that firms with a lower ratio are to be avoided.

When the equity ratio for a profitable company is relatively low, you’ll benefit from a higher return on investment because a smaller amount of overall equity is generating a greater level of returns.

This lower ratio value can be relatively easy to sustain when a business is in an industry with inherently low levels of competition, and relatively stable sales and profits.

Just the same, investors usually prefer to see a higher ratio since it demonstrates a more conservative approach to debt management.

A higher ratio value shows that a large number of shareholders consider the company to be a worthwhile investment, and it lets potential creditors know that the company is a good credit risk.

It’s also worth noting that there are fewer financing costs associated with less debt, so a business with a higher ratio value will be much less expensive to operate.

Cautions & Further Explanation

There is no caution for this ratio. However, using this ratio alone may potentially lead to a less useful valuation result.

As a value investor, you should never rely on a single ratio or investing metric to make your investment decisions.

So it is worth considering to use this ratio with other debt ratios, such as the quick ratio, current ratio or debt to equity ratio when performing your financial ratio analysis.