This is an in-depth guide on how to calculate Days Payable Outstanding with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a company's operating efficiency.

Definition - What is Days Payable Outstanding?

The days payable outstanding (DPO), often known as the average payment period, is a calculation that helps determine the efficiency of a business in paying its dues to suppliers.

In short, it measures how long in days it takes for a company to pay off its procured goods and services in a period.

The importance of cash in a business cannot be stressed enough. The days payable outstanding helps bring out the concept of balance and optimization for a business.

You want to pay off your dues to be able to keep your suppliers happy and hold their trust.

However, you also don’t want to finish all your freed up money on short notice. Finding the right balance can spell a world of difference for the company’s cash situation.

More...

Formula

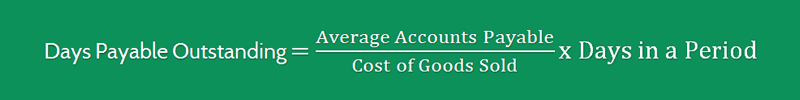

In order to calculate days payable outstanding for a company you would like to evaluate, you can use the following formula:

Days Payable Outstanding = (Average Accounts Payable / COGS) x Days in a Period

In order to calculate the average accounts payable, you just need to sum the beginning and ending accounts payable, and then divide the result by 2, as follows:

Average Accounts Payable = (Beginning AP + Ending AP) / 2

You can find all of these numbers on a company’s income statement and balance sheet.

Example

Okay now let’s take a look at a quick example so you can understand clearly how to calculate the accounts payable days.

Company A is experiencing issues with their suppliers, and they end up paying some penalties due to non-payment of bills.

To assess the situation management drilled down on the accounts payable of the company, you can use the accounts payable days, as follows:

Company A | |

|---|---|

Accounts Payable | $200,000 |

Cost of Goods Sold | $135,000 |

Days in the Period | 31 |

Days Payable Outstanding (DPO) | 45.92 |

Management discovered that they have not been fulfilling the 30-day credit terms to their suppliers, and that is why they ended up with penalties.

However, they managed the payments so that the urgent payments got first priority, making sure not to dry up the cash account. They are aiming for a 31-day DPO.

Okay now let’s consider another example.

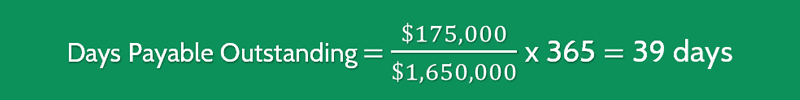

Assume that you are looking to examine how long it takes Company B to pay its suppliers.

Looking into the company’s financial statements, you found the following information:

- Beginning Accounts Payable = $150,000

- Ending Accounts Payable = $200,000

- Cost of Goods Sold = $1,650,000

- Days in the Period = 365 days

By using the DPO formula, we’ll arrive at the average accounts payable days of :

This suggests that it takes Company B about 39 days to pay invoices from its suppliers.

Interpretation & Analysis

In general, the shorter the DPO is, the better for the company.

A business that quickly addresses its short term or long term payments is set up for stability.

Many companies intentionally delay making some payments to improve their cash flow and prioritize the use of cash.

This could lead to a more optimized use of cash that ensures that the company is liquid enough at all times.

Strategically paying out the bills helps when the business faces sudden needs and requirements.

Due to this, a higher days payable outstanding should not be dismissed as a flaw, and should be further investigated.

If a company does have a short DPO, it will help take a peek at their cash situation.

If they are paying their creditors off quickly, but still have a sufficient amount of cash, then the company is in a good situation.

However, if the DPO is low but the company is struggling to make ends meet, the management should think of a way to manage their business money and dues in a more strategic manner.

Cautions & Further Explanation

It is imperative that you do not rely on this efficiency ratio to make a judgment on how the company is doing in terms of its payments due. The result you are seeing can also be an effect of strategy.

To assess the payables situation further, you could also check on the company's liquidity to be able to make a complete judgment on the average accounts payable days.

Having a low ratio may not always mean the best strategy for the company.