This is a thorough guide on how to calculate Cash Return on Assets Ratio (Cash ROA) with in-depth analysis, interpretation, and example. You will learn how to use its formula to assess a business profitability.

Definition - What is Cash Return on Assets Ratio?

The cash return on assets ratio, also known as the cash ROA ratio, is the ratio of a company's operating cash flow and its average total assets.

This profitability ratio shows you a clear picture of how well the company is generating cash flows from its assets.

In a nutshell, it measures how much the firm’s invested assets are making, against the actual cash it is collecting.

While net income is usually used to measure the profitability of a company, it’s more important to evaluate how the cash comes into and goes out of the business.

The cash return on assets ratio can help you assess the actual cash flows to the firm’s assets, and it’s not affected by any income measurements or income recognition.

This ratio can also be used to compare a company’s operating performance with other companies in the same industry.

In general, a higher cash ROA ratio indicates that the company is doing better at generating cash flows from its assets.

Conversely, a lower ratio shows that the company is not efficient in utilizing its assets to generate more cash flows.

More...

Formula

In order to calculate cash return on assets ratio, you can use the following formula:

Cash Return on Total Assets Ratio = Operating Cash Flow / Average Total Assets

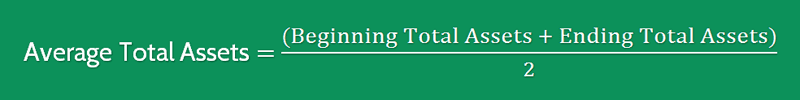

You can calculate the average total assets by summing the beginning and ending total assets, and then dividing the result by 2, as follows:

Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2

You can easily find the operating cash flow figure reported on a company’s cash flow statement, and the total assets on its balance sheet.

Example

Okay now let’s consider an example so you can see how easy it is to calculate the cash return on asset ratio.

For example, you are considering to invest in Company A, and you’d like to know how efficient this company is in utilizing its assets.

After looking into the company’s financial statements, you’ve found the following information:

Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

Operating Cash Flow | $38,000 | $46,000 | $62,000 |

Average Total Assets | $5,200 | $7,500 | $10,800 |

Cash Return on Average Assets | 7.30% | 6.13% | 5.74% |

As you can see that Company’s performance has been reducing over the past 3 years.

The ratio results show that this company is not efficient in utilizing its assets to generate more cash flows.

This ratio can also be used to compare companies within the same industry.

Now let’s consider another example. Assume that there are Company B and Company C, and their cash flow return on assets ratios are as follows:

Company A | Company B | Company C | |

|---|---|---|---|

Operating Cash Flow | $62,000 | $48,000 | $125,000 |

Average Total Assets | $10,800 | $4,600 | $16,200 |

Cash Return on Average Assets | 5.74% | 10.43% | 7.72% |

As you can see that even though Company B is generating less cash flows than the other two, it’s the most profitable company as it yields the highest cash flow return on assets.

That’s to say, Company B is more efficient in using its assets to produce more cash flows.

Company A seems to be the worst company to invest in since it came up with the lowest ratio value, and its performance has been reducing over the past 3 years.

Interpretation & Analysis

As an investor, you want to look for companies with a higher cash return on average total assets ratio.

A company with a high cash ROA ratio is considered a more favorable investment as it can generate more cash flows from its assets, thereby create more value for its shareholders.

On the other hand, having a low cash ROA is a sure sign that the company is not efficient in handling its asset management.

So what’s a good cash return on assets ratio?

Generally speaking, the higher the ratio, the better, as it indicates that the company is doing a great job of utilizing its assets to generate more cash flows.

To use this ratio effectively, you should look into a company’s performance over the past 3 to 5 years.

Evaluating multi-year performance will show exactly you how well the business is doing.

Cautions & Further Explanation

It should be noted that the cash return on assets ratio tends to be lower for asset-intensive companies, as they rely too much on their fixed assets.

The best way to determine if a company’s ratio is low or high is to compare its ratio with that of other companies within the same industry.

By looking at other companies’ performance and the industry averages, you can easily find out if your company is doing better than its peers, thereby you can make a better investment decision.

In addition, to draw a more accurate picture of how well a company is utilizing its assets, it’s worth considering using the cash ROA ratio with other asset assessment ratios, such as the RONA ratio, total asset turnover ratio, etc.