Are you tired of watching your investments go nowhere?

Do you want to learn how to maximize your cash earnings per share and take your wealth to the next level?

Then look no further because we've got the inside scoop on how to do just that.

Cash earnings per share (EPS) is a crucial performance metric for investors, which measures a company's profitability.

It tells investors how much cash a company is generating per share of its outstanding stock.

This metric can make or break a company's stock performance, and it's essential to keep a close eye on it.

To improve cash EPS, a company can adopt various strategies, such as focusing on revenue growth, reducing expenses, and increasing profitability.

Revenue growth is a critical factor in generating more cash flow, which can lead to higher cash EPS.

Similarly, reducing expenses can significantly impact cash EPS, and increasing profitability is always a good thing.

Apart from these strategies, there are several other ways to improve cash EPS, such as optimizing capital structure, managing working capital effectively, and using non-cash items.

For instance, companies can use weighted average number of shares or diluted number of shares to calculate cash EPS more accurately.

Equity shares available to a company can also impact cash EPS.

Therefore, it's crucial to analyze different companies and understand their strategies to improve cash EPS.

A high growth rate is another factor that can positively impact cash EPS.

Companies with a high growth rate can generate more cash flow, leading to a higher cash EPS.

Moreover, it's crucial to understand the difference between cash EPS and earnings per share (EPS).

While EPS can be impacted by non-cash items such as depreciation and amortization, cash EPS focuses on the cash generated by the company.

In this article, we have delved deep into the world of cash earnings per share and shared expert tips and insights on how to increase your cash EPS and grow your wealth.

We have provided real-world examples of companies that have successfully implemented strategies to improve their cash EPS.

So, if you're looking to take your investments to the next level, it's time to dive into our article and unlock the secret to skyrocketing your cash EPS today!

Definition - What is Cash Earnings per Share Ratio?

When evaluating a company's financial performance, it's important to consider different aspects of its earnings.

For example, companies can use different accounting methods, and certain items like depreciation can significantly impact a company's earnings.

That's why using cash to calculate EPS can provide a more accurate measure of a company's financial position.

Cash Earnings Per Share (Cash EPS or CEPS) is a measure of the cash generated by a company's operations for each share outstanding.

It is calculated by taking the operating cash flow from a company's financial statements and notes and dividing it by the diluted number of shares outstanding.

The operating cash flow represents the actual cash generated by a company from its core business activities, which excludes non-cash items such as depreciation and amortization.

By using cash EPS to evaluate a company's financial performance, investors can get a clearer picture of how much actual cash the company is generating.

This can help them assess the company's ability to fund its operations, pay dividends, and invest in growth opportunities.

Moreover, cash EPS can be particularly useful when evaluating companies that are involved in M&A activities or have significant capital expenditures.

In these situations, cash EPS can help investors understand how much actual cash a company is generating, as opposed to just looking at accounting earnings.

In addition to cash EPS, there are other types of EPS that investors may use to evaluate a company's financial performance, such as basic EPS and diluted EPS.

Each type of EPS has its own advantages and disadvantages, and it's important to consider all of them when evaluating a company's earnings.

Cash EPS is a valuable measure of a company's financial performance that provides a more accurate picture of the actual cash generated by a business.

It can help investors make more informed decisions about investing in the stock market, especially when evaluating companies that are involved in M&A activities or have significant capital expenditures.

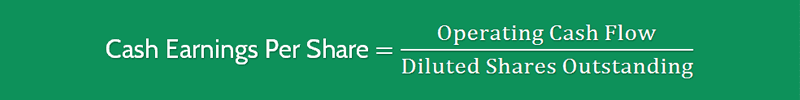

Cash Earning Per Share Formula

To calculate cash earnings per share, you just need to divide your operating cash flow by the diluted shares outstanding.

So the formula would look like this:

Cash Earnings Per Share = Operating Cash Flow / Diluted Shares Outstanding

This formula will tell you how much cash flow the company generates on a per share basis.

Cash EPS Example

Let’s say Company ABC has a total net income of $9,750,000 for the fiscal year. But their operating cash flow is $7,800,000.

When fully diluted, the company’s shares outstanding totals 1.7 million.

Using the correct cash EPS formula, the equation would be:

This gives the company a cash earnings per share of about $4.59 per share.

Operating Cash Flow Per Share - Interpretation & Analysis

The operating cash flow per share is a valuation ratio that indicates how much cash a company generates from its operations per share of common stock outstanding.

In the example above, the company's operating cash flow per share of $4.

59 is a good starting point, but it is not sufficient to determine if it's high or low without comparing it with other relevant figures.

To gain more insight, you should calculate the cash EPS for the company in previous years and compare it to the current figure.

You should also compare the cash EPS to the industry competitors to assess the company's position relative to its peers.

Furthermore, you should review the company's notes to accounts to see how it calculates cash EPS, ensuring it's adjusted for all non-cash items such as annual depreciation charges, changes in working capital, and M&A activity.

If the trend in cash EPS over the years is upward, that would indicate that the company is consistently generating more cash per share over time, which is an excellent sign.

Moreover, you should check that the company's operating cash flow per share is high compared to others in its industry, and at the very least, it should not fall below the average.

It's also essential to compare the cash EPS to the GAAP EPS, which is the earnings per share figure reported in a company's SEC filings.

If the cash EPS is lower than the GAAP EPS, it may be a red flag, but if it's higher, it's a promising indication that the company is growing.

Investors typically look for high cash EPS and dividend payments as an indication that the company is financially sound.

However, it's crucial to ensure that the cash EPS is adjusted for all non-cash items, unlike normal EPS.

When evaluating a company's financial performance, investors must compare both cash EPS and GAAP EPS to determine whether they're telling the same story.

By doing so, they can make informed investment decisions and avoid potential risks.

Cautions & Further Explanation

The ratio that compares a company's financial performance by examining its cash earnings per share (CEPS) is considered to be a more honest and realistic measure of its real earnings per share.

CEPS is calculated by adjusting the company's earnings to account for both cash and non-cash items on the income statement.

This adjustment allows investors to better understand the true financial and operational health of a company.

For instance, let's consider Company ABC and Company XYZ, with CEPS of $4.59 and $6.25, respectively.

At first glance, one may assume that Company XYZ is in a better position.

However, to gain a clearer picture of the companies' financial standing, we must look beyond CEPS.

Upon digging deeper, we discover that Company ABC has a reported GAAP EPS of $3.

40, while Company XYZ has a reported GAAP EPS of $8.60.

This finding reveals that Company ABC might be earnings accretive as it has a lower CEPS but a higher GAAP EPS than Company XYZ.

Additionally, it's crucial to analyze the CEPS ratio in full context.

This involves understanding the elements in the income statement and adjusting for non-cash items that occur over the life of the assets.

If a company is making significant investments in long-term assets, it's likely that the increase in CEPS might not be sustainable in the long run.

Thus, it's important to evaluate the increase in CEPS against other financial metrics and the company's overall financial health.

CEPS is a critical ratio to examine when evaluating a company's financial performance.

However, it's equally essential to analyze this ratio alongside other financial and operational metrics to obtain a comprehensive view of a company's financial standing.

Frequently Asked Questions

Q: What is cash earnings per share?

Cash earnings per share is a financial metric that represents the amount of cash generated by a company for each share of common stock outstanding. It is calculated by dividing a company's cash flow from operations by its total number of outstanding shares.

Q: How is cash earnings per share different from earnings per share?

Earnings per share (EPS) is a measure of a company's profitability that takes into account its net income and the number of outstanding shares. Cash earnings per share, on the other hand, looks at the cash generated by a company from its operations, which can be a more accurate measure of a company's financial health.

Q: Why is cash earnings per share important?

Cash earnings per share is important because it shows how much cash a company is generating from its operations, which is a key indicator of its financial health. This metric can be especially important for companies that have a lot of debt or that are investing heavily in their business.

Q: How can I use cash earnings per share to evaluate a company's stock?

Investors can use cash earnings per share to evaluate a company's stock by comparing it to the stock's price-to-cash-earnings ratio (P/CE). A lower P/CE ratio indicates that the stock is undervalued, while a higher P/CE ratio may indicate that the stock is overvalued. Investors can also compare a company's cash earnings per share to its competitors to see how it stacks up in its industry.

Final Words

Congratulations on reaching the end of our blog post about cash earnings per share (CEPS)!

Now that you have a better understanding of this essential financial metric, it's time to start thinking about how you can maximize your cash earnings per share.

CEPS is a performance metric that shows the profitability ratio of a company that compares its earnings to the number of outstanding shares.

It's an important metric because it indicates the amount of cash that a company has generated that can be distributed to its shareholders.

To maximize your earnings per share, it's important to focus on the cash earnings, which could be affected by non-cash elements.

This is why it's important to analyze your financial statements carefully and identify areas where you can optimize your revenue and reduce costs.

In addition to this, you should also explore ways to increase your market share, expand your product line, or invest in new technologies.

By doing so, you can improve your company's overall performance, and in turn, boost your CEPS.

It's worth noting that every company has high cash earnings potential, and it's up to management to estimate the best use of cash.

By doing so, analysts can compare your company's financial performance with other similar product companies.

Remember that maximizing your CEPS is a journey, not a destination.

It takes time, dedication, and a willingness to learn from your mistakes.

So, keep on learning, keep on practicing, and most importantly, keep on taking action.

In summary, we hope this blog post has inspired you to take the necessary steps to master your financial ratio analysis skills.

By focusing on the cash earnings, analyzing your financial statements, and investing in your company's growth, you can achieve great success.

Furthermore, it's essential to make capital investments that can generate higher cash earnings in the future.

By doing so, you can ensure that your earnings per share keep growing year after year.