This is a complete guide on how to calculate Return on Revenue Ratio (ROR) with detailed interpretation, example, and analysis. You will learn how to use its formula to evaluate a company's profitability.

Definition - What is Return on Revenue Ratio?

Among the many ways of measuring the profitability of a company, the return on revenue ratio (ROR), is one of them.

As the name suggests, this ratio works by comparing the net income of a company to its total revenue.

The factors that affect the ROR ratio are those factors that affect the profits and sales revenue of a company.

These include: the cost of sales, expenses incurred, product quantity demanded, trade discounts, the market reached, just to mention but a few.

These values can both be derived and extracted from the income statement of a company.

A business can easily increase its return on sales revenue by making changes to its sales mix, by improving its earnings, or by cutting unnecessary expenses.

Since this ratio is tied with the net profit, it also puts a significant impact on the company’s earnings per share (EPS).

More...

Formula

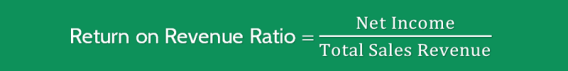

You can easily calculate the return on revenue ratio by using the following formula:

Return on Revenue Ratio = Net Income / Total Sales Revenue

Similar to the net profit margin ratio, to find this ratio, you just need to take the net income and then divide it by the total sales revenue.

You can easily find the net income and sales revenue figures reported on a company’s income statement.

Example

Okay now let’s consider an example so you can see how easy it is to calculate this ratio.

For example, you are investing in Company C and you’d like to evaluate how efficiently this company is generating profits from selling its products or services.

After going through its income statement, you’ve found the following data:

Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

Sales Revenue | $200,000 | $232,000 | $285,000 |

Net Income | $33,000 | $34,000 | $38,000 |

Return on Sales Revenue | 16.50% | 14.65% | 13.33% |

At first glance, you may think that Company C has been doing very well over the past 3 years as its income statement showed a consistent increase in both sales revenue and net income.

However, when you look at this company’s total return on its sales revenue, you can easily see the potential problem here.

The ROR ratio value has been declining over the past 3 years. This is a red flag indicating an inefficiency in this firm’s operation.

The declining return on total revenue is a sign that the management has failed to control their business operating expenses, which eventually affected the company’s bottom line or its net income.

In fact, if this business has been operating efficiently, it should have made more profits, and as an investor, you can expect this company to have a higher growth in its net income.

Interpretation & Analysis

The return on sales revenue ratio over a period of time will also signal you on when to recall your investment.

If the ROR ratio has been declining over time, then it shows that the profits are reducing.

If it is consistent, it is advisable to withdraw your investment, as it is not meeting the expected returns.

This ratio together with other profitability ratios can be used to ascertain whether a company is profitable or not.

The revenue is as a result of the total income generated by the company from the sale of its products and services.

If the company reports an increase in revenue and net income, the return on sales revenue ratio should show the same result.

So what is a good return on revenue ratio?

In general, the higher the ROR ratio, the better. This ratio is more useful when you use it to compare the operating performance of a company over the past 3 to 5 years.

By looking at multiple year performance, you can easily find out if the company is doing well in managing and controlling its operating expenses, thereby you can judge how efficient the company is.

As an investor, you can find out whether the revenue made is the best that the company can attain the prevailing conditions.

If not, for instance, you can go one step further and discover if the company’s management has adopted a different production and sales mix to increase their business revenue and hence the net profit.

Cautions & Further Explanation

The reason we invest is to make profits out of our investments, and hence the ROR is a critical ratio to understand and consider.

However, you should keep in mind that this ratio cannot make much financial sense when used without other financial ratios.

In addition, this ratio only uses the content in the income statement and does not consider items such as assets and liabilities, which are found in the balance sheet.

Therefore, using this ratio alone cannot allow you to know what the company owes and is worth.

While measuring the profitability of a company, other ratios such as the return on assets ratio (ROA) and the return on equity ratio (ROE) are fundamental.

All these ratios should be used together with the ROR, to determine the wholesome profitability of a company.

It is hence recommended that you should attempt to understand these ratios in order to make sound decisions.