This is a complete guide on how to calculate Average Collection Period with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a company's operating efficiency.

Definition - What is Average Collection Period?

The amount of time it takes a business to receive its owed payments in terms of its accounts receivables or credit sales is known as the average collection period, or days sales outstanding (DSO).

This measure is important as it highlights how the company's accounts receivables are being managed.

This calculation gives the business managers time to make any required adjustments to prepare for any future obligations that might require cash from sales.

As a general rule, a low average receivables collection period is seen to be more favorable as it indicates that customers are paying their accounts faster.

On the other hand, a higher average collection period could suggest that sales are being converted to cash much slower than required.

More...

Formula

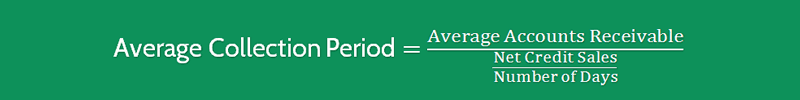

The formula to measure the average collection period is as follows:

Average Collection Period = Average Accounts Receivable / (Net Credit Sales / Number Of Days)

The average receivables period is computed by dividing Net Credit Sales by 365 days, and then dividing the result into Average Accounts Receivables.

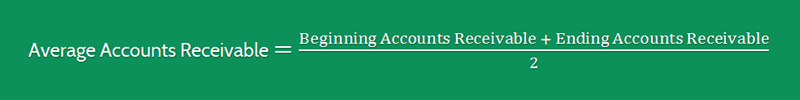

So how can you calculate the average accounts receivable?

That’s easy: you just need to sum the beginning and ending balance of the company’s accounts receivable, and then divide the result by 2, like this:

Average Accounts Receivable = (Beginning AR + Ending AR) / 2

You can easily get these figures on a company's balance sheet and income statement.

Example

Okay now let’s have a look at an example so you can see exactly how to calculate the average receivables in days.

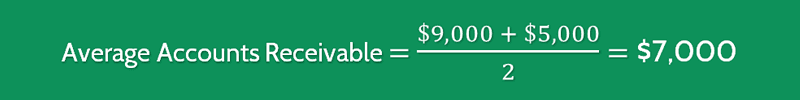

MNO Company has beginning accounts receivables of $9,000 and ending account receivables of $5,000. Its net credit sales are $250,000.

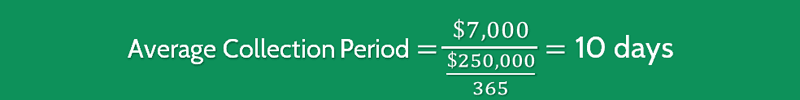

To determine the average payment period we need to substitute into the formula:

This suggests that on average, customers are paying their credit accounts every 10 days.

Interpretation & Analysis

We can provide further context to this figure by looking at previous year results.

So what is a good average collection period?

If last year the average receivables collection period was 20 days, this would suggest an improvement and that customers are paying their credit accounts quicker which, as a general rule, is good for the business.

If on the other hand, the average collection period last year was 5 days, you would want to look at why customers are now taking longer to pay and how this is affecting the business with regards to cash flow.

Cautions & Further Explanation

To provide value, the average receivable days need to be compared to other companies within the same industry.

An average of 10 days might seem like a good period in comparison to peers whose average might be 20 days, but you need to consider the impact this would have on your customers.

It might not be that competitors are managing their receivables any worse, but rather, that they have more favorable terms and so customers might leave you and go to them.

The average receivables collection period can be managed within the credit terms set out to customers.

If customers are paying later than agreed, it may lead to issues with cash flow as the duration between the sale and the payment is stretched.

It might, at this point, be an idea to offer a small discount on payment within a certain time or other favorable terms to increase the speed of payment.