If you’re looking for advice before jumping into the value investing world, you should consider these basic concepts for understanding exactly what a value stock is, and how to determine which ones offer the best potential for your investment portfolio.

Value investing is driven by the idea that there are ways to benefit financially from the events that cause stock market prices to swing up and down.

In fact, by learning how to swim effectively against the current, you’ll soon discover that there are outstanding opportunities in the value investing

More...

What Exactly is Value Investing?

Before jumping into the value investing world, you have to understand the basic concepts behind value investing.

On one level, a stock’s value is reflected in its current market price.

Since the market price indicates how much investors are willing to pay for a stock at any given time, it indicates the stock’s market value.

But the key point to note in value investing is that a stock’s market value is not the same thing as its fundamental, or intrinsic, value.

Sometimes businesses can become temporarily popular or unpopular for a variety of reasons that have little to do with the true worth of their revenues, net assets, or their future income potential.

When a company’s stock is undervalued, it means that it’s selling at a price well below the value of its current and predicted cash flows.

At the same time, a stock that’s overvalued is one that’s selling at an inflated price, well beyond its current earnings value, or even its predicted earnings growth.

So what exactly is value investing?

In short, value investing is simply a method for understanding how to effectively value a stock in terms of its intrinsic value, in order to determine the best time to buy or sell it for a profit.

To take advantage of the benefits of value investing, you’ll first learn to identify truly valuable companies in order to buy them when they’re undervalued.

Most commonly, the eventual goal of this strategy is to sell these stocks when they become overvalued, or once their prices have returned to a more realistic level.

In this way, you will often be buying and selling stocks against the natural flow of movement within the stock market.

Since it’s a well-documented principle that investors tend to overreact to both good news and bad news, you can use this truth to look for companies that are currently undervalued by the market, despite their long-term fundamental worth.

Investing Tip

If an undervalued company is financially strong, with a solid profit history and promising future earnings, its market price is very likely to rebound after a temporary downswing caused by investor fear or disfavor.

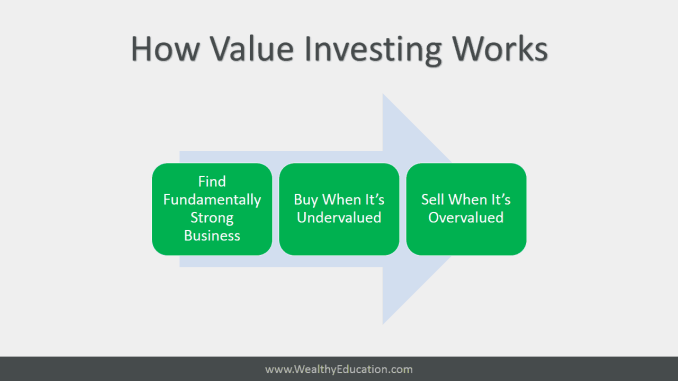

3 Real-World Steps to Implement the Value Investing Strategy

The best value investing strategy starts with learning to identify fundamentally strong companies.

If you attempt to profit by buying stocks that have simply dropped in price, without first ensuring that they have the underlying ability to eventually recover, there’s a good chance you’ll experience some financial loss instead.

An effective value investing formula dictates that we must first look for strong businesses, buy when their stock is undervalued, and sell when it rebounds or becomes overvalued.

Below are the 3 essential steps to every value investor should follow to become successful in this value investing world.

Step 1: Look for Fundamentally Strong Businesses

Value companies are not named for their positive market values, since every company’s stock price fluctuates on a regular basis in conjunction with individual news events, or occurrences within the market as a whole.

A fundamentally strong business is known as a value company because it possesses actual, inherent worth in terms of its consistent earnings, dividends, and cash flow.

These companies usually have a sustainable competitive advantage over their rivals that keeps them in the game, regardless of what their stock price may be doing from day to day.

And it’s this competitive edge that gives businesses a protective economic moat.

To understand how to identify economic moats, you should look for companies with the ability to remain financially competitive over the long-term.

Even if negative events cause a fundamentally strong company’s stock price to dip, if it can maintain its ability to continue operations as usual, it will generally rebound in time to a market price that is more in keeping with its true value.

Investors tend to have emotionally short memories.

Important Note:

As long as a company continues to demonstrate a consistently growing net income and cash flow, it’s very likely to not only eventually regain its former glory after a price drop, but to become overvalued as investors start to recognize all over again what great value it represents!

When looking for fundamentally strong businesses, some additional factors you should keep in mind are low debt, and the presence of a strong and responsive management team.

Overall, if a company has a history of performing well, you can predict that it will continue to do so over the long-term.

Once you’ve identified businesses that are fundamentally strong and that have a high intrinsic value, you should add them to your watch list in order to consider buying them if, and when, they ever become undervalued.

Step 2: Buy Stocks When They Are Undervalued

Under normal circumstances, stocks that are financially strong, and that demonstrate promising future prospects, are relatively expensive to purchase.

For this reason, a fundamentally strong business doesn’t always represent a good investment, since its stock value will have little potential to increase if you buy it when it’s already trading at a price that’s more or less in line with the company’s intrinsic value.

In short, it’s important to be able to recognize undervalued stocks, so you don’t end up buying them at the wrong time.

A strong company can become temporarily undervalued for a number of reasons.

These can include one-time events such as internal scandals or negative news reports that cause disillusionment, but that don’t cause the company to lose its competitive edge, or its ability to go about its business as usual.

If you wait for such occurrences as a company failing to meet its projected earnings, a downturn in the economy, a significant change in a company’s business environment, or similar types of bad news, you’re apt to discover that the short-term emotional impact of these events on investors causes a company’s stock price to decline.

This temporary price decrease is your signal that a stock may have become undervalued, and is now a good investment buy for your portfolio.

Step 3: Sell Stocks When They Become Overvalued

Now that you understand that the best time to buy into a financially strong company is when its stock has become undervalued, you also need to recognize when to sell that stock in order to generate a profit.

Although we know that a high quality company can be temporarily affected by negative market news that causes its stock price to plunge, we also know it’s very likely to recover over the long-term.

And in the same way that bad news can cause a company’s stock price to drop, good news can have the opposite effect and cause its price to surge during this recovery period.

In either case, whether a business simply recovers its true value in time because of its intrinsic value, or becomes suddenly overvalued as the result of some positive event like share buyback, it will probably be time to sell your stock and take your profit in the spirit of buying low and selling high.

How to Value a Stock – Calculate its Intrinsic Value!

As we discussed earlier, the real worth of any business is not always reflected in its market price, but can usually be found in its actual or intrinsic value.

A company’s intrinsic value lies in a combination of both tangible factors, such as its assets and earnings, and intangible factors, such as the dynamics of its management team, and its business reputation.

In putting all of these pieces together, you’ll discover how to value a company based on its real merit, rather than on its perceived value in the eyes of the market, and it’s this knowledge that will allow you to make better investment decisions.

At its most basic level, the value investing formula tells us that we should buy stocks when their intrinsic value is greater than their current market value because this is when they are considered to be undervalued.

At the same time, when a stock’s intrinsic value drops below its current market price, it has become overvalued, and should be sold.

Important Note:

- A stock is Undervalued when: Intrinsic Value > Market Value

- A stock is Overvalued when: Intrinsic Value < Market Value

Many investors simply choose to look at the Price to Earnings (P/E) ratio of a stock as an indicator of whether a company is undervalued or overvalued at a given point in time, but this method is not always reliable.

A stock’s P/E ratio measures its current share price against its per-share earnings in order to arrive at a relative value for that stock.

If a stock is currently trading at $10 per share, for example, and its earnings were $1 per share over the past year, its P/E ratio would be $10/$1 or simply 10.

This figure tells you just how much investors are willing to pay for a stock, per dollar of the company’s earnings.

As such, a relatively low P/E ratio may indicate that a company is currently undervalued in terms of its earnings history.

But there are several limitations when using a company’s historical P/E ratios as a benchmark for determining when its stock has become undervalued.

Some of these limitations include the fact that:

- No single analytical measurement is reliable on its own

- Different market sectors grow and are valued in different ways

- A company’s debt can sometimes significantly affect its earnings, and can therefore skew its P/E ratio

Sometimes the earnings figure used in the P/E ratio can be inaccurate to begin with, since earnings reports are often manipulated by companies in an effort to maintain strong stock prices.

Instead of using the P/E ratio, you may want to try some better financial ratios like the PEG and PEGY ratios.

These ratios are considered an enhanced version of the P/E ratio because they provide a closer look at the relationship between a company's earnings and its future growth potential.

However, as a value investor, you would be far better off calculating the intrinsic value of a company by making use of the Discounted Cash Flow (DCF) model.

While the DCF formula is somewhat complex, it involves plugging in the figures that represent a company’s future free cash flow projections, and discounting them to adjust for the time value of money, in order to arrive at an estimate of the company’s present value.

If the DCF value of a company is higher than its current market price, it may represent a good investment opportunity.

Investing Tip

Don't rely on a single investing metric.

It would be better if you calculate the intrinsic value of your stock by using some developed models like the DCF model and Dividend Growth Model, and then use several investing ratios like the PEG and PEGY ratios to support your investment decision.

How to Build a Diversified Portfolio

The next step to become successful in the value investing world is to build a diversified portfolio.

Although value stocks offer the potential to provide some of the highest market returns and profits, you shouldn’t make the mistake of relying on them as the sole investment vehicle within your portfolio.

"Don't put all your eggs into one basket." - Anonymous

Investing your money in nothing but business stocks involves the inherent risk that the businesses you invest in may collapse, or go bankrupt.

No business, no matter how financially strong it is, is immune to the possibility of experiencing a decline in performance in the future.

Building a diversified portfolio can help to minimize your investment risk exposure, and is an absolute must if you want to become successful in the stock market.

By introducing securities into your investment strategy that include Exchange Traded Funds (ETFs) and income stocks, as well as value stocks, you’ll be well positioned to both spread out any unavoidable risks, and to maximize your returns.

The Bottom Line

Remember that value investing is all about finding value businesses, buying them when they are undervalued, and selling them when their stock prices become overvalued, or more in line with their intrinsic values.

Getting started in value investing is the best way to invest in the stock market, since it offers the greatest chance of generating the highest returns.

But because the entire concept of value investing lies on the foundation of being able to identify undervalued stocks, it’s important that you take the time to learn all you can about how a company is valued and exactly what contributes to that valuation.

Before buying any stock you should have a thorough understanding of its fundamentals in terms of its past financial performance, and its projected future growth and earnings.

Beyond reading all the good things a company may have to say about itself, you should become knowledgeable about the meanings behind such terms as earnings, cash flow, revenues, dividends, and debt load.

The more informed you are as an investor, the more likely you will be to find success in building your long-term wealth.

Now it's your turn to jump into the value investing world!

What's your favorite investment approach? Feel free to share your thoughts in the comment's section below.