This is an ultimate guide on how to calculate Sales to Operating Income Ratio with in-depth interpretation, analysis, and example. You will learn how to use its formula to assess a firm's efficiency position.

Definition - What is Sales to Operating Income Ratio?

The sales to operating income ratio, also known as the net sales to operating profit ratio or net sales to EBIT ratio, allows you to examine the relationship between a company’s net sales and its operating income in more detail.

This ratio works by measuring what proportion of a firm's sales revenue is left over after paying for variable production costs such as raw materials, wages, etc.

The sales revenue to operating income ratio, in a way, tells you how efficient the business model of a company is in generating profits.

In general, it gives you an idea of how much money the business is making (before taxes and interest) on each dollar of sales.

More...

Formula

You can easily calculate the sales to operating income ratio by using the following formula:

Sales to Operating Income Ratio = Net Sales / Operating Income

Operating Income is also called EBIT (earnings before income and taxes).

It is the income left after all operating and administrative costs, and overheads have been taken out from the revenue.

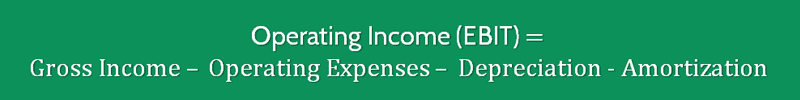

Operating Income (EBIT) = Gross Income – Operating Expenses – Depreciation - Amortization

Net sales can be calculated by subtracting the total value of returned goods, sales discounts and sales allowances from the company’s total sales.

Net Sales = Sales Revenue - (Sales Returns + Sales Allowances + Sales Discount)

You can easily find this information on a company’s income statement.

Example

Okay now you know all the formulas, let’s consider an example.

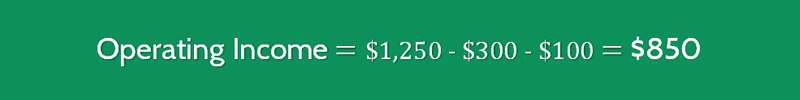

Company A has $1,250 in gross income. The operating expenses are $300 and depreciation is $100. The company did $2,000 in gross sales. The value of goods returned is $100.

As you can see that this company has a net sales to operating income ratio of 2.24.

However, this ratio alone will tell you nothing about how the company is doing.

To use this ratio effectively, you should compare the performance of a company in the past 3 to 5 years so you can see if there’s any improvement or decline in the sales revenue to operating profit ratio.

This information can tell you exactly if the company is doing better or worse in the past couple of years.

Interpretation & Analysis

In general, a lower value of this ratio is better.

For the same sales revenue, a company will want as much operating income as possible.

Between two firms having similar sales, we could look at this ratio and figure out which firm is consistently able to generate higher EBIT.

A firm generating a higher operating income is better placed to survive economic downturns.

It also has more flexibility to lower prices if need be due to its higher margin.

This ratio is useful for both the management of the company as well as a prospective investor.

It indicates the effectiveness of the business process that is driving the sales.

The management of a company can compare this ratio with that of its peers and find out areas in which it can bring about improvement to increase its efficiency, and thereby operating income.

Cautions & Further Explanation

You should be careful while comparing firms using the sales to operating profit ratio.

Different industries have different acceptable profitability levels which depend on multiple factors.

Thus, the comparison will be meaningful only when the underlying characteristics of the industries are comparable.

Like most ratios, just by looking at this value, you cannot make a judgment about the direction in which the firm is going.

A higher value could either be because of an increase in sales or a dip in operating income (which could be due to a spike in costs among other things).

Similarly, a decline in the ratio may be because of higher EBIT or lower sales.

Thus, we cannot comment just by looking at the historical trend whether it is a good sign or not.

You should study the financial statements of the firm in detail and figure out the cause for the change in parameters.

The inverse of this ratio is called operating profit margin ratio.

It is a very popular metric to look at the profitability of a company. You should be careful and not confuse between the two.