This is a complete guide on how to calculate Return on Average Equity (ROAE) with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a company’s profitability.

Definition - What is Return on Average Equity?

The return on average equity (ROAE) is a measure of a company’s net income in relation to its average shareholders’ equity value over the past two years.

It is similar to return on equity (ROE), with the only difference being the denominator.

In the ROA calculation, the denominator is shareholders’ equity, as opposed to average shareholders’, which is used as the denominator in ROAE.

The distinction is made between the two because shareholders’ equity is constantly changing from share buybacks and additional stock issuance.

So ROAE uses the average shareholders’ equity because some investors argue that it is a more accurate figure than regular shareholders’ equity.

More...

Formula

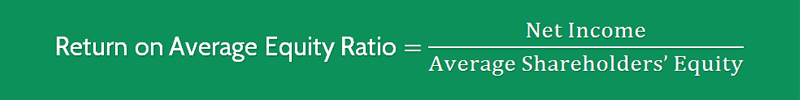

The equation for return on average equity ratio is as follows:

Return on Average Equity Ratio = Net Income / Average Shareholders’ Equity

To compute ROAE, you simply take a company’s net income, which is found on its income statement, and divide it by its average shareholder’s equity.

Average shareholders equity is found by adding together the the past two years’ shareholders’ equity figures, and dividing that number by two.

If we were calculating ROE, the denominator in the equation would be the current shareholders’ equity figure.

Example

To make the concept of the return on average shareholders’ equity ratio clearer, we will go through an example.

Suppose Company YYY generated $50 million in net income this year. Additionally, this year the company has $200 million in shareholders equity, and last year it had $250 million in shareholders equity.

Therefore, plugging in $50 million for net income, and $225 million (($200 + $250)/2) for average shareholders’ equity, this company’s return on average shareholders’ is calculated to be 22.2%.

Meaning, the company’s net income is 22.2% of its average shareholders’ equity.

If we were to compute regular ROE, it would come out to 20%, because we would divide net income by the current year shareholders’ equity figure ($250 million).

Interpretation & Analysis

The return on average common shareholder’s equity is a useful metric that can inform investors how efficient the company is turning their equity investments into profits.

A high ratio means that the company is turning a large percentage of its equity figure into net income. That’s a sign of an efficient business.

Moreover, a low ratio could be a sign of a poorly run business that doesn’t turn equity investments into heft profits.

Therefore, investors typically look for investments with a high ROAE ratio to ensure their capital will be efficiently turned into profits.

Cautions & Further Explanation

The limitations of the return on average common equity stem from its simplicity. Its only inputs are net income and average shareholders’ equity.

The problem with this is that equity is not the only source of financing for a company.

Companies can raise money via debt and preferred shares as well.

So, a company could have an incredibly high ROAE, but if it has an enormous amount of debt, the company’s stock would not be as attractiveness of an investment as the ROAE would lead you to believe.

Therefore, along with this ratio, it is important to look at return on assets (ROA) and debt to equity ratio, along with other financial metrics, before investing in any company.