If you're new to the world of finance, it's essential to understand various ratio measures, including the price to book ratio (P/B ratio), which is used to evaluate stocks.

The P/B ratio is a metric that can help you make smarter investment decisions by measuring a company's market value relative to its net book value, calculated by dividing the market price per share by the book value per share.

The book value is the value of a company's assets minus its liabilities and is considered a more conservative measure of its worth, based on its balance sheet.

Understanding the P/B ratio is crucial as it can help you identify undervalued or overvalued stocks.

A low P/B ratio suggests that a stock may be undervalued and could be a good investment opportunity.

In contrast, a high P/B ratio could indicate that a stock is overvalued and may not be worth the investment.

Moreover, there are many other ways to use the P/B ratio to your advantage.

For instance, you can use it to compare a company's P/B ratio to its industry peers or historical averages.

You can also use the P/B ratio to assess a company's asset value compared to its book value of equity.

In general, the P/B ratio may be an effective tool to determine whether a stock's market price is too high or too low based on its fundamentals.

If you're a seasoned investor or just starting, understanding the P/B ratio can be critical to making informed investment decisions.

So, if you're ready to unlock the secrets behind the price to book ratio, dive into this post and discover how this important metric can help you make smarter investment decisions.

Definition - What is Price to Book Ratio?

The price to book ratio (P/B) is a fundamental valuation ratio used by investors to assess the value of a company's stock.

It is calculated by dividing the market value of the company by the book value per share.

The P/B ratio provides insights into how the market values a company relative to its underlying assets.

While there is no universally ideal P/B ratio, a lower ratio is generally preferred by investors as it suggests that the stock may be undervalued.

However, it is essential to exercise caution, as a low ratio could also indicate underlying issues with the company that may pose risks.

It's important to note that the value of the P/B ratio can vary significantly across different industries.

Therefore, to gain a clearer understanding of the ratio's significance, it is advisable to compare it to similar companies within the same industry.

By examining the P/B ratios of comparable firms, investors can better evaluate the relative value of a company's stock.

If your investment objective is to identify undervalued companies, the P/B ratio can serve as a valuable tool for uncovering high-growth companies available at lower prices.

A P/B ratio below 3.0, for example, could be considered noteworthy and may warrant further investment consideration.

In financial ratio analysis, the price to book ratio is just one of many metrics used to evaluate a company's performance and value relative to its peers.

Other financial ratios, such as PEGY ratio and return on average equity, can provide a comprehensive view of a company's financial health.

By considering the P/B ratio alongside other relevant financial ratios, investors can make more informed investment decisions.

However, it's important to remember that financial ratios are tools and should be used in conjunction with thorough research and analysis to make well-rounded investment choices.

In summary, the price to book ratio reflects the value that the market places on a company relative to its total book value.

While there is no definitive benchmark for an ideal P/B ratio, a lower ratio is generally preferred.

Comparing the P/B ratio to similar companies within the industry can provide additional context.

Investors interested in finding undervalued companies can use the P/B ratio as part of their valuation analysis, alongside other financial ratios, to identify potentially attractive investment opportunities.

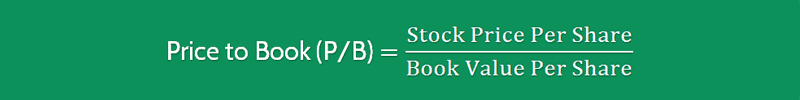

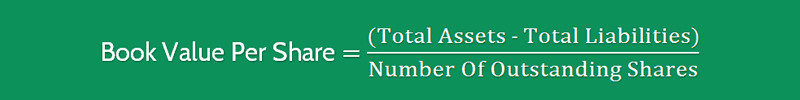

Formula

The formula to measure the Price to Book value is as follows:

Price to Book (P/B) = Stock Price Per Share / Book Value Per Share

Book Value Per Share = (Total Assets - Total Liabilities) / Number Of Outstanding Shares

You can find this information on a company’s financial statements.

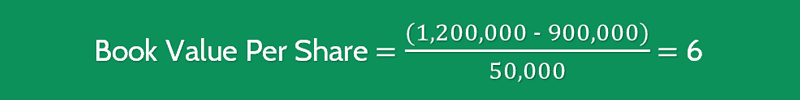

Example

NAW Company has the following information on its financial statements:

- Total Assets: $1,200,000

- Total Liabilities: $900,000

- Number of Outstanding Shares: 50,000

- Stock Price Per Share: 18.75

NAW Company’s P/B ratio is 3.13 which is slightly above the guideline of 3.0 for an investment consideration.

Interpretation & Analysis

If your goal as an investor is to find undervalued companies, then NAW Company would probably not be a good option if you were being strict with the 3.0 guideline.

However, as it is so close to the guideline, as an investor, you would probably want to assess the company using other ratios before dismissing it completely as it could still be a good investment.

One important ratio to consider is the price-to-book ratio, which is calculated by dividing the company's market value per share by the value of its assets as shown on the company's balance sheet.

This ratio is important as it provides insight into the accounting value of the company relative to its book or underlying value.

Without context, the ratio is difficult to evaluate, and so we would need to look at other companies within the same industry in order to understand it further.

By comparing NAW's price-to-book ratio with that of similar companies, we can gain a better perspective.

If similar companies had much higher ratios, then it could be a sign that NAW is either undervalued or, alternatively, has something fundamentally wrong with it that you would need to find out with further analysis.

In addition to the financial ratios, another factor to consider is the presence of intangible assets.

Intangible assets are assets that do not have a physical form but can still add significant value to a company, such as intellectual property, brand reputation, or patents.

These assets are not usually reflected on the balance sheet, but their presence can greatly impact a company's overall worth.

Therefore, when evaluating NAW Company, it would be important to consider whether the company has any significant intangible assets that are not captured by the price-to-book ratio alone.

These assets could potentially contribute to the company's underlying value and make it a more attractive investment option.

While the price-to-book ratio provides a valuable metric for assessing a company's value, it should not be the sole determinant in investment decisions.

By analyzing other ratios, considering the company's relative position within the industry, and taking into account intangible assets, investors can gain a more comprehensive understanding of a company's true value and make more informed investment choices.

Cautions & Further Explanation

Companies can account for their assets in different ways, which means that the stated book value of a business may not accurately reflect its true asset value.

This variation in accounting methods can lead to significant disparities in financial reporting.

For instance, one company might choose to aggressively depreciate its assets, while another could take a more conservative approach, resulting in distorted financial results.

When assessing a company's value, analysts often rely on the price-to-book ratio, which compares the company's stock value relative to its book value.

This ratio is frequently used as a measure of how the market values a company's assets.

A good price-to-book ratio is subjective and can vary depending on various factors, such as the industry, economic conditions, and investor sentiment.

Different analysts may have contrasting perspectives on what constitutes a favorable ratio.

Some may argue that a low ratio indicates an undervalued stock and, therefore, represents a good investment opportunity.

Conversely, others may view a low ratio as a sign of an inferior investment, suggesting that the company is potentially overvalued or facing challenges.

The price-to-book ratio can be calculated by dividing a company's market value relative to its total assets minus any liabilities.

This ratio may provide insights into how investors perceive the company's financial health and growth prospects.

However, it's important to note that the price-to-book ratio has its limitations and should not be solely relied upon when evaluating investment opportunities.

The use of the price-to-book ratio offers a glimpse into the market's assessment of a company's worth based on its assets.

Nevertheless, the interpretation of this ratio may vary widely among analysts and investors, leading to diverse opinions on whether a particular ratio indicates an undervalued or overvalued stock.

It's crucial to consider additional factors, such as the company's competitive position, management expertise, and future growth potential, before making investment decisions.

Frequently Asked Questions

Q: What is price to book ratio (P/B ratio)?

Price to book ratio is a financial metric that compares a company's stock price to its book value per share. It's calculated by dividing the market price per share by the book value per share.

Q: How is P/B ratio useful for investors?

P/B ratio is useful for investors as it gives an indication of whether a stock is undervalued or overvalued compared to its book value. A P/B ratio below 1 indicates that the stock is trading below its book value, which may be an attractive investment opportunity. Conversely, a P/B ratio above 1 suggests that the stock is trading at a premium to its book value, which may indicate that the stock is overvalued.

Q: What are some limitations of using P/B ratio?

One of the limitations of using P/B ratio is that it doesn't take into account a company's future growth potential or its intangible assets such as brand value, patents, and trademarks. Additionally, different industries may have different average P/B ratios, so it may not be useful to compare P/B ratios across different sectors.

Q: How does P/B ratio differ from P/E ratio?

P/B ratio and P/E ratio are both valuation metrics used by investors, but they measure different aspects of a company's financial health. P/B ratio compares a company's stock price to its book value, while P/E ratio compares a company's stock price to its earnings per share. While P/B ratio may be more appropriate for companies with significant tangible assets, P/E ratio may be more relevant for companies with high growth potential.

Final Words

Congratulations!

You have reached the end of this blog, and we hope that you are now feeling excited and inspired about the potential of using financial ratios, such as the price-to-book ratio, in your investment decisions.

However, before we part ways, we want to leave you with one final thought that you can carry with you on your investment journey.

Let us take a moment to imagine that you have achieved your financial objectives.

You are living the life you have always envisioned, with a comfortable income, a thriving investment portfolio, and the freedom to pursue your passions.

How does that success look to you?

How does it feel to know that you have made intelligent choices and taken calculated risks to reach this point?

At the core of this achievement lies the ability to comprehend and utilize financial ratios like the price-to-book ratio.

This tool allows you to determine a company's assets' value and compare it to its share price, enabling you to make informed investment choices and establish a robust and diversified portfolio.

However, the key to success does not solely depend on grasping the theory behind financial ratios but lies in putting that knowledge into practice.

Whether you are a seasoned investor or just starting, we encourage you to keep learning, experimenting, and taking action to achieve your financial goals.

With dedication and a bit of luck, anything is possible!

The price-to-book ratio is a critical metric for any investor to be familiar with.

This ratio is calculated by dividing the current market value of a company's assets minus its liabilities by the total number of outstanding shares.

This calculation provides investors with the value that an investor is paying for each share compared to the value of the company's assets.

If the ratio is less than one, it could mean that the stock's price is reasonable, and if it is greater than one, it could indicate that the stock is overpriced.

In conclusion, we thank you for joining us on this journey of learning and discovery in the world of finance and investing.

We hope that you will return soon for more insights, ideas, and inspiration.

Until then, keep striving for success and never stop learning!