Are you intimidated by the complex terminology and confusing concepts of the financial world?

Worry no more!

Today, we will delve into one of the most significant financial terms - Net Asset Value Per Share (NAV) - and explain it in simple terms.

You might be wondering, what exactly is NAV, and why is it important?

If you're interested in investing, understanding NAV is crucial in determining the real value of a company's shares.

NAV represents the value of a company's total assets minus its liabilities, divided by the number of outstanding shares.

This calculation provides the value of each share if the company sells all its assets and pays off all its debts.

However, there's more to NAV than meets the eye.

For instance, it can be used to determine whether a stock is undervalued or overvalued.

Additionally, it can identify potential investment opportunities.

NAV is computed for mutual funds, ETFs, unit investment trusts, and other similar investment vehicles.

It represents the per-share value of the fund's net assets, which includes the value of all its securities, cash, and other assets.

In this blog post, we will explore how to calculate NAV and discuss how it differs from the actual market price.

We will also provide examples of how NAV is used in real-world scenarios to make informed investment decisions.

Whether you're a seasoned investor or just starting, this article is a must-read.

To calculate NAV, you need to subtract the fund's liabilities from its assets and divide the result by the total number of outstanding shares.

The resulting number is the NAV per share.

It's important to note that the NAV is computed at the end of each trading day and is based on the closing prices of the securities held by the fund.

You can also calculate the NAV between two dates to measure a fund's performance over a specific period.

Understanding NAV is crucial for investors looking to make informed investment decisions.

By knowing how to calculate NAV, you can determine a fund's true value and whether its market price is undervalued or overvalued.

So, dive into the article now and unlock the secrets of successful investing!

Definition - What is Net Asset Value Per Share?

The net asset value per share (NAVPS), sometimes simply referred to as ‘net asset value’, is a valuation ratio that calculates the value per share of a mutual fund, investment fund, or company.

This value is a representation of the total value of the fund's assets minus the total value of the fund's liabilities.

In other words, it is the amount that each share of the fund would be worth if it were liquidated.

The net asset value per share is an important metric for investors because it can provide insight into the current value of their investment.

Investors can use this measure to compare the value of a company’s stock to the actual price it is being bought and sold at, allowing them to potentially identify undervalued or overvalued businesses.

Investors should also compare the net asset value per share of different companies within the same industry or benchmark to evaluate the value of their investment.

By dividing the net asset value of a fund by the total number of shares outstanding, investors can determine the fund’s NAV per share.

A mutual fund’s NAV can change on a daily basis, and this fluctuation reflects changes in the value of the securities held by the fund.

For publicly traded investment funds or companies, investors can use the NAVPS to determine whether the stock is overvalued or undervalued.

In conclusion, the net asset value per share is a crucial expression for net asset value that represents the value of assets in an investment fund, mutual fund or company, based on their NAV.

By comparing the NAVPS of different companies, investors can make informed decisions about buying and selling their shares, and potentially gain an advantage over other investors in the market.

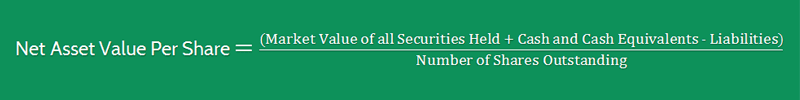

Formula

The formula to measure the net asset value per share is as follows:

Net Asset Value Per Share = (Market Value of all Securities Held + Cash and Cash Equivalents - Liabilities) / Number of Shares Outstanding

You can find these numbers on a company’s financial statements.

Example

ACE Company has the following figures on its financial statements:

- Securities: $12,000,000

- Cash and Cash Equivalents: $1,500,000

- Liabilities: $700,000

- Shares Outstanding: 1,600,000

As you can see that ACE Company’s net asset value per share is $4.1.

Interpretation & Analysis

As previously mentioned, calculating a company's net asset value per share (NAVPS) is an essential metric used to evaluate the performance of a fund or a business.

It is typically calculated once per day at the end of the trading day, and investors must calculate their NAV daily or at least keep track of it regularly.

The NAV is calculated by subtracting the company's liabilities from its assets and dividing the result by the number of outstanding shares.

The higher the NAVPS, the better it is for investors.

However, to understand the meaning of the result, we would need to use the industry benchmark or compare it to other companies.

For instance, if the benchmark is higher than ACE Company's NAVPS, this may indicate that the value is lower than it ideally should be, and competitor businesses are performing better.

Conversely, if the benchmark is lower than ACE's numbers, we could assume that the company is potentially performing better and generating more value to each of its shares.

Suppose the stock price is $3.5, as an investor, you would be inclined to consider investing in the company since the stock is potentially undervalued on the market, making it a good 'deal.'

However, before investing, it is essential to conduct further investigation into the business and not rely solely on ratios and metrics of analysis.

Calculating a company's NAVPS is an important metric for evaluating a fund or a business's performance.

It is calculated once per day at the end of the trading day, and investors must calculate their NAV daily or at least keep track of it regularly.

Comparing a company's NAVPS to the industry benchmark or other businesses can help investors understand the meaning of the result.

Finally, it is crucial to conduct further research into a business before investing, even if its NAVPS appears to be undervalued on the market.

Cautions & Further Explanation

The market price of a closed-end fund or an exchange-traded fund can provide an alternative way to assess the fund's value compared to the net asset value per share (NAVPS), which is based on the fund accounting for its total assets and liabilities.

The market price reflects the demand and supply dynamics of the fund, and investors can purchase or sell the fund's shares based on this price.

However, one major flaw of relying on the NAVPS is that the results can quickly become historic.

As shares are bought and sold each day, the number of shares outstanding can change quickly, making the NAVPS very much a snapshot of a single point in time as opposed to a whole period, thus limiting its value.

Moreover, the fund's total value depends on the market prices of its assets, which can be subject to volatility and uncertainty.

The fund may hold both short-term and long-term liabilities, such as accrued expenses and long-term liabilities.

These liabilities can reduce the fund's net value, which is the difference between the total value of its assets and liabilities.

The fund may also have accrued income, which is the revenue earned but not yet received, and this can increase the net value of the fund.

Therefore, investors should consider both the NAVPS and the market price when evaluating a fund's value.

While the market price may provide a more dynamic and timely reflection of the fund's value, the NAVPS can give a more accurate and comprehensive picture of the fund's assets and liabilities.

Ultimately, investors should conduct thorough research and financial ratio analysis to make informed investment decisions.

Frequently Asked Questions

Q: What is net asset value per share?

Net asset value per share (NAVPS) is a measure of the value of a company's assets per outstanding share of its stock. It is calculated by dividing the total value of a company's assets, minus its liabilities, by the number of outstanding shares of its stock

Q: How is net asset value per share calculated?

To calculate net asset value per share, a company adds up the total value of its assets, such as property, equipment, and cash, and subtracts its liabilities, such as debts and other obligations. This net value is then divided by the total number of outstanding shares of the company's stock.

Q: Why is net asset value per share important?

Net asset value per share is important because it can give investors an idea of the underlying value of a company's assets. It is also used as a benchmark for determining the performance of mutual funds and other investment vehicles that hold a portfolio of assets.

Q: How does net asset value per share affect investors?

Investors can use net asset value per share to evaluate the potential return on investment in a company's stock or in a mutual fund. If the net asset value per share is higher than the current market price, it may indicate that the stock or mutual fund is undervalued and could be a good investment opportunity. On the other hand, if the net asset value per share is lower than the market price, it may indicate that the stock or mutual fund is overvalued and could be a risky investment.

Final Words

Congratulations on reaching the end of this blog post!

I sincerely hope that the information presented here has been both informative and engaging for you.

Now, let's take a moment to think about your desired success.

Envision yourself achieving all of your financial goals, feeling secure in your investments, and reaping the rewards of your hard work.

Financial stability and freedom are what we all aspire to achieve.

If you are interested in investing, there are several important concepts that you should understand.

One of these concepts is the net asset value per share, or NAV.

The NAV is calculated by dividing the net value of a fund's assets by the number of outstanding shares.

Knowing the NAV is essential because it gives you insight into the fund's performance, its expenses, and its potential future returns.

This is particularly important when considering investment options like mutual funds.

Investing can be a daunting task, but it doesn't have to be.

With the right information, resources, and mindset, anyone can become a savvy investor and achieve their financial dreams.

Keep learning, practicing, and don't hesitate to ask for help when you need it.

To delve a little deeper into investment, it's essential to understand the book value, total market value, and price per share.

Book value refers to the total value of a company's assets minus its liabilities.

The total market value, on the other hand, is the total value of all outstanding shares of a company's stock.

The price per share is calculated by dividing the total market value by the number of outstanding shares.

Now, let's talk about fund shares.

When you invest in a mutual fund, you are essentially buying a portion of the fund.

The fund owns a variety of assets, including stocks and bonds.

When you buy a share of the fund, you are entitled to a portion of the fund's returns.

It's also worth noting that funds may have millions of dollars in short-term and long-term liabilities, which can impact their overall performance.

In summary, achieving financial success is possible with the right mindset, knowledge, and resources.

Understanding concepts like NAV, book value, total market value, and price per share can help you make informed investment decisions.

And remember, investing is a journey that requires ongoing learning and practice.

So, keep up the good work, and best of luck on your investment journey!