This is a detailed guide on how to calculate Defensive Interval Ratio (DIR) with thorough interpretation, analysis, and example. You will learn how to use its formula to assess a business liquidity.

Definition - What is Defensive Interval Ratio?

The defensive interval ratio (DIR) is another liquidity ratio that tells us the number of days for which a business can continue operating without using its non-current assets.

Unlike the current ratio which compares a company’s liquid assets to its liabilities (a balance sheet item), this ratio compares liquid assets to operating expenses (an income statement item).

This ratio is called the defensive interval ratio as we use the current assets of a company (also called defensive assets) in its calculation.

More...

Formula

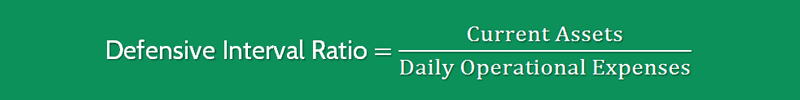

You can easily calculate the defensive interval ratio of a company by using the formula below:

Defensive Interval Ratio = Current Assets / Daily Operational Expenses

Liquid assets include all assets that can easily be converted into cash, including cash & cash equivalents, marketable securities, accounts receivable, etc.

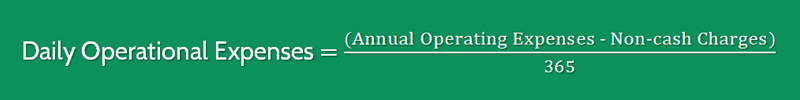

We can calculate the daily operational expenses by taking the cost of goods sold and annual operating expenses and then adding back non-cash expenses such as depreciation.

The resultant figure is divided by 365 to get the daily average.

Daily Operational Expenses = (Annual Operating Expenses - Non-cash Charges) / 365

All of these figures can be found on a company’s income statement and balance sheet.

Example

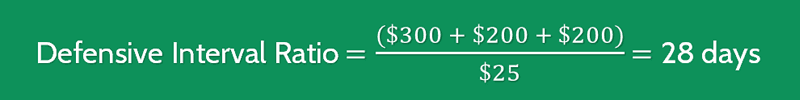

Now that you know the exact formula for calculating the DIR, now let’s consider an example.

Company A has $300 in cash, $200 in marketable securities and $200 in receivables. The average daily expenditure of the firm is $25.

By using the above formula, you can easily calculate this company’s DIR, as follows:

The ratio value of 28 suggests that the company will run out of cash after 28 days.

Interpretation & Analysis

This ratio tells us about the financial strength of the company by showing us how long the firm can last on its liquid assets without using any external investment or liquidating any of its long-term assets.

The above example tells us that this firm can stay operational for 28 days by just relying on its liquid assets.

An increasing value of DIR suggests that the company is able to generate more liquid assets for its operations.

On the contrary, a decreasing trend suggests that the liquid assets of the company are declining.

So what is a good defensive interval ratio?

You should keep in mind that this ratio is more useful when used to compare companies in similar industries

.A single ratio value will tell you nothing about whether a company is doing well in utilizing its liquid assets.

But when you compare the defensive interval ratios of multiple companies in the same industry, you will instantly find out which company is the best player and which one is the worst.

Cautions & Further Explanation

You should use this ratio along with other liquidity ratios to comment on the financial situation of a company.

This ratio is a variation of current ratio and you should be careful when mixing the two up (the differences between the two are discussed above).

Taken together, these ratios can provide a better view of a company's ability to cover its short-term obligations.

Another aspect that you should keep in mind is that the daily expenses of a business are not consistent.

There could be periods when there is no meaningful expenditure or very high expenditure.

Thus, the ratio might not be very accurate in predicting the number of days for which the company's liquid assets will be able to support its operations.

Just like expenditure, cash receipts of the business are unpredictable.

Therefore, you should keep these points in mind before drawing any insights from this ratio.

While calculating this ratio, we have to be careful about what to include in liquid assets and daily operational expenses.

In the numerator, we only include those items that can easily be converted into cash.

In the denominator, we only include expenses that are related to day to day operations of the business.