Welcome to the world of finance, a realm where numbers reign supreme and the asset coverage ratio holds the throne among metrics.

If you're not familiar with this term, don't worry – you're not alone.

But once you learn what it is and how it can benefit you, you'll wonder how you ever managed without it.

Asset coverage ratio is a crucial metric for both investors and lenders as it measures a company's ability to pay off its debts based on its assets.

It's not just a technical jargon but an essential metric that determines the level of financial risk associated with a particular company or investment.

The formula to calculate the asset coverage ratio is by dividing the company's total assets by its total debt, which includes both short-term and long-term debt as well as current liabilities.

Understanding the asset coverage ratio is vital for your financial stability, whether you're an investor, business owner, or simply someone who wants to keep their finances in check.

It enables you to assess a company's financial health and determine its ability to repay its debts.

By using this metric, you can evaluate the risk associated with investing in a particular company, which in turn helps you make informed decisions about where to put your money.

However, asset coverage ratio isn't only beneficial for investors.

Business owners can also make use of this metric by monitoring their own asset coverage ratio.

By doing so, they can identify potential financial problems early and take action to prevent them.

It's a valuable tool that can help business owners make informed decisions and maintain their financial stability.

In summary, the asset coverage ratio is a critical metric that measures a company's ability to repay its debts based on its assets.

It cannot be easily overlooked as it determines the level of financial risk associated with a particular investment.

Therefore, it's essential to understand this metric whether you're an investor or a business owner.

So, why wait? Calculate the asset coverage ratio and discover the power it holds for yourself!

Definition - What is Asset Coverage Ratio?

When considering investing in a company, there are several essential tools to evaluate whether the investment is worthwhile.

One of the most important financial ratio analysis tools is the asset coverage ratio, which helps determine a firm's ability to pay off its debt using its assets.

The asset coverage ratio measures a company's tangible and intangible assets, which include everything from buildings and equipment to intellectual property and brand recognition, against its current liabilities or short-term debts.

This ratio is especially crucial for lenders and investors as it determines whether the company's assets can cover its debt obligations to them.

In situations where a company is unable to pay off its debt, selling off these assets may be the only solution.

When analyzing the asset coverage ratio, it's generally agreed upon that the higher the coverage ratio, the better.

A higher ratio indicates that the business can fulfill its debt obligations against its assets, making it a safer investment option.

Capital management and equity ratio also play a significant role in determining a company's financial health.

The asset coverage ratio is calculated by subtracting the total debt from the tangible and intangible assets and then dividing that number by the total debt.

Analysts generally agree that for utilities companies, the asset coverage ratio should be at least 1.5, while industrial companies should aim for a ratio of at least 2.0.

Anything below these levels would signal that the company does not have the ability to pay back all of its debts using its assets.

The asset coverage ratio is a risk management tool used to assess a company's financial health, allowing investors and lenders to determine whether a company is a safe bet for their investments or loans.

It provides insight into the company's ability to cover its debt obligations with its assets, making it a critical ratio to consider before deciding to borrow or invest.

Formula

The simplest way for you to calculate the ratio is by using the following formula:

Asset Coverage Ratio = ((Assets - Intangible Assets) - (Total Current Liabilities - Short-term Debt)) / Total Debt

This information can be found easily on the company's balance sheet and other financial statements.

- “Assets” refers to the total company assets

- “Intangible assets” are assets that are not physical e.g. goodwill.

- “Short-term Debts” are those that are due within one year.

- “Total Debt” is all outstanding short and long term debt.

Example

ABC Co is an investment company and has the following on its financial statements:

- Tangible Assets (Total Assets - Intangible Assets): $2,350m

- Current Liabilities: $870m

- Short-Term Debts: $624m

- Total Debts: $900m

We would substitute this into the equation as follows:

ABC Co’s Asset Coverage ratio is 2.34 which suggests that ABC Co does have the ability to pay off its debts given its assets.

As we are analyzing an investment company, this ratio would have had to have been over 2 to be acceptable to investors.

Another example of a company in a different industry is as follows:

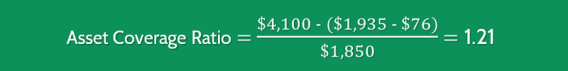

XYZ Co is a Utilities company and has the following on its financial statements.

- Tangible Assets (Total Assets - Intangible Assets) = $4,100m

- Current Liabilities = $1,935m

- Short-Term Debts $76m

- Total Debts $1,850m

We would substitute this into the equation as follows:

XYZ Co’s Asset Coverage ratio is 1.21 which would suggest to investors that there would be a strong likelihood that XYZ would not have the ability to pay off its debts given the assets it has to draw upon.

As we are analyzing a Utilities company, this ratio would have had to have been over 1.5 to be acceptable to investors.

Interpretation & Analysis

When assessing a company's financial stability, one important financial metric to consider is the asset coverage ratio.

The asset coverage ratio measures the extent to which a company's assets can cover its financial obligations, specifically its outstanding debts.

It is calculated by dividing the company's asset value by its total borrowings.

A higher asset coverage ratio is generally seen as favorable, as it indicates that the company has a greater ability to settle its debts.

When the ratio is above the recommended guideline of 1.5 or 2 (depending on the industry), it suggests that the company possesses sufficient assets relative to its total borrowings.

This indicates a lower risk of defaulting on its financial obligations in the future.

Conversely, if a company's asset coverage ratio falls below the recommended guideline for its industry, it signifies that the company may not have enough assets to rely on in the event it needs to repay its debts.

This lower ratio indicates a higher risk for lenders and investors, as it implies a reduced ability to settle financial obligations.

It's important to note that the asset coverage ratio is calculated by dividing the asset value by the total borrowings.

The asset value represents the numerator in the formula, while the total borrowings serve as the denominator.

By analyzing this ratio, stakeholders gain insights into a company's financial health and its capacity to meet its obligations.

For capital goods companies or those with substantial fixed assets, maintaining a higher asset coverage ratio is crucial.

These companies often require significant investments in infrastructure, equipment, and machinery.

Therefore, a higher ratio offers a sense of security to creditors, as it indicates that the company has valuable assets that could be used to settle its debts.

The asset coverage ratio serves as a useful tool for investors, creditors, and analysts when evaluating a company's financial stability.

It helps determine the level of risk associated with providing financial support to a company.

Lenders, for instance, may use this ratio as a criterion for granting loans or determining interest rates.

Understanding the minimum asset coverage ratio recommended for a specific industry is essential.

Various sectors have different risk profiles and capital requirements, which influence the acceptable level of coverage.

Deviations from the industry guideline should be carefully assessed, as they may indicate potential financial distress or a higher probability of default.

By analyzing the asset value and total borrowings, stakeholders can gain insights into a company's financial health and make more informed decisions about providing financial support.

Cautions & Further Explanation

The ratio that measures a company's ability to cover its debts on a standalone basis has some significant flaws.

One of the major flaws of this ratio is that it is based on a company's 'book value', which may inflate the ratio and thus portray an overly optimistic reflection of the company's financial health.

In order to overcome this issue, analysts can instead value the assets at their actual depreciated value rather than their book value.

This approach would provide a much more realistic representation of the company's asset ability versus its debt.

Another way to reduce the possibility of skewed results when using the 'book value' is to compare the ratio against other asset coverage results from similar companies in the same industry.

This would give equity investors a better understanding of the reliability of the result.

On a standalone basis, the ratio may not provide the most accurate picture of a company's financial health.

For instance, if a company were to sell off its assets, then the ratio would be higher because the debt amount remains constant while the assets lessened.

Therefore, this ratio would likely be more informative when used alongside several other performance and coverage ratios in order to develop an all-round, accurate view of a company and its abilities.

It is also worth noting that a ratio of 1x is not necessarily ideal for all companies.

Some companies may require a higher or lower ratio depending on their business model, industry, and growth trajectory.

Therefore, it is important to compare the ratio against ratios of other companies in the same industry to get a better understanding of what is considered an appropriate ratio for that particular industry.

Ultimately, analyzing a company's assets in order to determine its financial health is a complex process that requires a thorough understanding of various financial ratios and metrics.

Frequently Asked Questions

Q: What is asset coverage ratio and how is it calculated?

Asset coverage ratio is a financial metric that shows the ability of a company to repay its debts using its assets. It is calculated by dividing the company's total assets by the amount of its outstanding debt.

Q: Why is asset coverage ratio important for investors?

Asset coverage ratio is important for investors because it provides insight into the financial health and stability of a company. If the ratio is high, it indicates that the company has a strong ability to repay its debts. On the other hand, a low ratio could be a red flag for investors as it may suggest that the company may struggle to meet its debt obligations.

Q: How is asset coverage ratio used in credit analysis?

Asset coverage ratio is a key metric used in credit analysis as it helps lenders assess the level of risk associated with lending money to a company. A higher ratio indicates a lower level of risk as the company has more assets to use as collateral to repay its debt.

Q: How does asset coverage ratio differ from other financial ratios?

Asset coverage ratio is unique from other financial ratios such as liquidity ratios, profitability ratios, and solvency ratios because it focuses specifically on a company's ability to repay its debts using its assets. Other ratios may provide different perspectives on a company's financial health and performance.

Final Words

Congratulations on making it to the end of our discussion on the asset coverage ratio!

This powerful financial metric can be an essential tool in achieving your desired financial success.

With a clear vision of where you want to be financially, the asset coverage ratio can help you determine how to get there.

The asset coverage ratio is a risk measurement that assesses your ability to cover your debts with your assets.

By measuring the ratio of assets to pay off liabilities, you can make informed decisions that will put you on the path to financial success.

To calculate the ratio, simply divide your total assets by your total liabilities.

A ratio of 1 or more indicates that you have enough assets to cover your debts, while a ratio of 1.0-1.5x is generally considered risky, and 1.5-2.0x is the norm.

However, financial success is not just about the numbers.

It's about taking action and using the information to make smart financial decisions.

Analyze your ratio and identify areas for improvement.

Perhaps you could consider selling some of your assets, such as notes to accounts or intangible assets, to increase your ratio.

Alternatively, you could focus on increasing your tangible assets to boost your financial health.

Furthermore, paying interest and principal on your debts is essential to maintaining a healthy asset coverage ratio.

A low ratio could indicate that you are at risk of defaulting on your payments.

It's essential to keep a close eye on your ratio, as it provides a picture of your financial health.

Remember, non-physical assets are an essential part of the asset coverage ratio.

Still, it may be necessary to remove intangible assets from the calculation to get a better understanding of your financial position.

Keep learning and practicing, and soon you'll be on your way to achieving your financial goals.

The fixed asset coverage ratio is a crucial financial metric that can help you make informed decisions about your financial future.

By analyzing your ratio and taking action to improve it, you can mitigate the riskiness of your financial position and put yourself on the path to financial success.