This is a complete guide on how to calculate Debt to Income (DTI) ratio with in-depth interpretation, analysis, and example. You will learn how to utilize its formula to assess a company's solvency.

Definition - What is Debt to Income Ratio (DTI)?

The debt to income ratio offers yet another way for you to measure a company’s income against its current debt load, but it does so by examining monthly revenues and recurring monthly debts.

Although this ratio is most often used by lending institutions to financially size up a personal loan applicant, it can also be used by those same institutions to gauge a commercial firm’s ability to remain solvent.

This becomes especially important in situations where a business may be looking to borrow additional funds.

The lender involved will want to make sure the company’s income is capable of supporting a higher level of debt, while still leaving enough cash to fund its regular operations.

In a similar fashion, the debt to gross income ratio can be used just as effectively by you, to evaluate a company’s debt load situation before you decide to invest.

Simply put, the D/I ratio allows you to calculate what percentage of a firm’s earnings is being spent to cover its monthly debt payments.

More...

DTI Formula

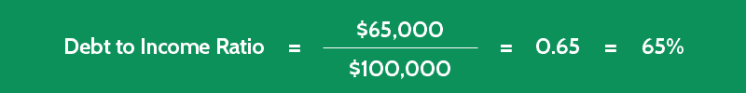

How do you calculate debt to income ratio? The formula looks like this:

An organization’s total monthly debt payments will include such charges as interest expenses, loan payments, or lease payments.

Where there’s no monthly income figure available for the business you wish to evaluate, you can simply divide its gross annual income by 12.

Read also: Equity Ratio - Formula, Example & Analysis

Debt To Income Calculator

Example

Now you know the exact DTI formula, let's consider this example so you can understand clearly how to figure out debt to income ratio.

You’re considering investing in Company T, but would like to adopt the professional eye of a financial lending institution to take a closer look at any potential risk surrounding the sustainability of the company’s debt load.

When you examine Company T’s financial statements, you determine that its gross income and recurring debt payments are as follows:

- Gross Annual Income = $1,200,000

- Monthly Loan Interest = $35,000

- Monthly Loan Payments = $20,000

- Monthly Lease Payments = $10,000

Using this information and the formula given above, you can now calculate Company T’s D/I ratio:

In this scenario, you can see that almost two thirds of every dollar Company T earns each month is being paid out to service its debt obligations.

Interpretation & Analysis

Okay now we're done with the DTI ratio calculation. Let's dive into how to use this ratio to evaluate a company's solvency.

It should be evident that the lower the debt to gross income ratio is, the better, since a lower value means the business in question is using a smaller percentage of its monthly income to repay its debts.

With less money going toward debt payments, the company will have more money available to support ongoing business operations, to cut debt costs by increasing loan payments, or to manage additional debt expenses if and when another loan is needed.

So what's a good debt to income ratio?

The exact value of an acceptable debt to income ratio can be hard to pin down.

Standards vary from industry to industry, and even from lender to lender, since some financial institutions are more willing to accept higher levels of risk than others, in exchange for higher interest rates.

The fact is that almost every business carries some level of debt, but the higher the DTI ratio is, the less likely it is that a company will be able to sustain its debt load from month to month.

Beyond servicing its debt costs, if a firm has little or no cash left at the end of each month, it will have little to work with in terms of expanding its business operations.

And with a high DTI ratio, the company will find it difficult to borrow the necessary funds to finance any plans it may have for that future growth.

This situation would not translate into a particularly inviting investment opportunity.

Cautions & Further Explanation

Although the lower ratio values are more preferable, this does not mean that you cannot invest in a business with a high D/I ratio.

In fact, when it comes to investing, no single ratio or investing metric can tell you exactly how a company is performing.

Therefore it is worth considering to use this ratio with other solvency assessment ratios so that you can paint a clear picture of a company's debt position.