Are you tired of feeling uncertain about your business's financial health?

Are you looking for a game-changing metric that can revolutionize the way you look at your finances?

If so, you're in luck, because we're about to explore the world of the cash debt coverage ratio.

Now, I understand that the term "cash debt coverage ratio" might not sound exciting at first glance.

However, this metric is far from boring.

In fact, it could be the key to unlocking financial success for your business.

So, what exactly is the cash debt coverage ratio?

Simply put, it's a coverage ratio that measures a company's ability to pay off its debts by analyzing the amount of cash flow generated compared to the amount of debt it owes.

This ratio is especially important for companies with a highly leveraged capital structure that are using a significant amount of debt capital to finance their operations.

By calculating the cash debt coverage ratio, you can determine whether your business has enough cash to cover its outstanding debts.

This information is crucial because it can help you make smarter financial decisions for your company.

For instance, if your ratio is low, it might indicate that your business is at risk of defaulting on its debt repayments.

In contrast, a high ratio would suggest that your business is in a good position to repay its debts.

Knowing your cash debt coverage ratio can also make it easier to secure funding from lenders or investors.

When you can demonstrate that your business has a strong ability to pay off its debts, you're more likely to attract potential investors.

To calculate the ratio, you need to determine your company's cash flow from operations and divide it by the amount of debt repayment due during the same period.

This calculation will give you a figure that represents the number of times your company can cover its debt obligations using its cash flow from operations.

The cash debt coverage ratio is a powerful tool that can help you understand your company's financial health and make informed decisions about its future.

Whether you're a business owner looking to improve your financial position or a finance enthusiast eager to learn something new, understanding this metric is essential.

So, why not take the time to calculate your company's ratio and unlock the power of the cash debt coverage ratio today?

Definition - What is Cash Debt Coverage Ratio?

The cash debt coverage ratio, also known as the cash flow to debt ratio, is a solvency ratio that measures a company's ability to pay off its short-term and long-term debt using the cash flow generated from its operations.

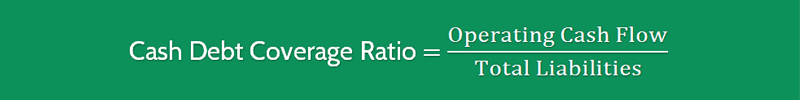

The ratio formula involves dividing the operating cash flow of a company by its total liabilities.

A current cash debt coverage ratio of over 1.0 or at an ideal level of 1:1 is generally regarded as being better.

This would indicate that the company has a strong capability of using the cash flow from its operations to pay off the amount of its debt repayments, including current liabilities.

This is seen as very comfortable for investors and creditors, as it implies that the company has a healthy financial position and a low risk of defaulting on its debt obligations.

On the other hand, a cash debt coverage ratio below 1.0 or close to 0 would serve as a strong warning that the company's financial health is bleak.

It implies that the company is generating insufficient cash flow to meet its debt obligations and may struggle to repay its creditors.

This could potentially lead to defaulting on its debt and negatively impact the company's credit rating.

Comparing a company's cash debt coverage ratio with those of other companies in the same industry can be a useful benchmarking tool for investors and creditors.

A ratio that is significantly lower than the industry average could suggest that the company is facing financial difficulties or operating in a highly competitive market.

The cash debt coverage ratio is a critical liquidity ratio that measures a company's ability to meet its debt obligations using the cash generated from its operations.

It serves as a vital indicator of a company's financial health and is closely monitored by investors and creditors.

A higher ratio is generally better, while a lower ratio is a warning sign that should not be ignored.

Formula

The formula to measure the cash debt coverage is as follows:

Cash Debt Coverage Ratio = Net Cash Provided By Operating Activities / Total Debt

So divide the net cash of the business that is provided by its operating activities i.e. operating cash flow by the total debt of the business.

You can easily find these numbers on a company’s balance sheet and cash flow statement.

As you can see in the formula, this ratio compares a company’s operating cash flow with its total liabilities.

That’s why this efficiency ratio is also reffered to as the cash to total debt ratio.

Example

Okay now let’s consider a quick example so you can see exactly how to compute this ratio in real life.

At December 31st 2015, GLK Company had operating cash flows as recorded in its statement of cash flows of $735M and total debt of $1,003M.

To determine the cash flow to debt, we need to substitute into the formula:

The workings show that GLK Company operates at a cash to debt coverage level of 0.73 (or 73%).

Interpretation & Analysis

In our previous example, we evaluated the cash debt coverage ratio of GLK Company.

Although a ratio of 0.73 would seem to be at a reasonable level, it is not the most desirable.

Typically, a result over 0.8 would be the most desirable, and over 1.0 is considered the best.

This financial ratio analysis indicates that GLK Company could pay off the dollar amount of its debt from the cash flow of its own operations.

The cash debt coverage ratio is a solvency ratio that measures a company's cash flow to debt.

A high ratio shows that the company has sufficient operational cash to pay off its total debt.

In general, a cash debt coverage ratio of over 1.5 is considered a good coverage ratio result.

This means that the company's available operational cash is 1.5 times greater than its total liabilities.

Therefore, the company can easily cover its debt obligations by using its current operational cash.

Moreover, it is important to note that the cash debt coverage ratio is different from the debt ratio.

The debt ratio is a coverage ratio that compares the average current liabilities to the company's cash flow from financing.

On the other hand, the cash debt coverage ratio compares the company's operational cash to its total debt.

Therefore, it is crucial to use the cash debt coverage ratio as a measure of the company's ability to use the cash it generates to pay off its debt.

The cash debt coverage ratio is an essential financial ratio that helps investors and creditors assess a company's financial health.

It measures the company's ability to use the cash it generates to pay off its debt.

In addition to the cash debt coverage ratio, there are other financial ratios that investors and creditors can use to evaluate a company's financial health.

Cautions & Further Explanation

To get a clear picture of a company's financial health, it is imperative to use a variety of ratios and not rely solely on one figure.

While a high ratio may seem ideal, it could be misleading without considering other factors.

For instance, a company with a high current ratio may not have enough cash to make debt repayments if necessary, which could be a problem in the long run.

Comparisons between companies in the same industry and between current and previous ratio results can provide insights into a company's performance.

A debt coverage ratio is a useful ratio calculator that helps evaluate a company's ability to pay off its debts based on its operations.

If a company has a cash debt coverage of 1:1, it means that it has constant cash flows to pay off its debt.

However, if the ratio declines, it could signal a problem, and it is necessary to understand what has happened to the company's cash flow.

One of the essential aspects of a company's cash flow is cash from operations, which is calculated using the formula for the cash conversion cycle.

A low ratio might seem unattractive to investors, but it could be an indicator that the company is becoming more able to pay off its debts based on its operations.

Free cash flow is another critical measure of a company's cash flow, which is calculated by subtracting capital expenditures from cash from operations.

Using a range of ratios provides a more comprehensive understanding of a company's financial health, and it is crucial to consider all factors before making any investment decisions.

Frequently Asked Questions

Q: What is the Cash Debt Coverage Ratio, and how is it calculated?

The Cash Debt Coverage Ratio (CDCR) is a financial ratio that indicates a company's ability to cover its short-term debt obligations with its available cash flow. To calculate the ratio, you need to divide the company's operating cash flow by its total debt payments.

Q: Why is CDCR important for investors and lenders?

CDCR is an essential financial metric for investors and lenders because it provides insight into a company's liquidity and financial health. A high CDCR indicates that a company has sufficient cash flow to meet its debt obligations, which is a positive sign for lenders and investors.

Q: What does a high or low CDCR mean for a company?

A high CDCR suggests that a company has enough cash flow to pay its debt obligations, indicating financial stability and strength. In contrast, a low CDCR implies that a company may struggle to meet its debt obligations, which can lead to default or bankruptcy.

Q: How can a company improve its CDCR?

A company can improve its CDCR by either increasing its cash flow or reducing its debt payments. To increase cash flow, a company can look for ways to increase sales, reduce expenses, or improve its operating efficiency. Alternatively, a company can reduce its debt payments by refinancing its debt, negotiating better payment terms with its creditors, or selling off non-core assets to generate cash.

Wrap Up

Are you ready to take control of your finances and achieve your desired success?

As we come to the end of this blog, let's imagine your financial success for a moment.

Maybe it's buying your dream house or traveling the world without worrying about your bank balance.

Whatever your aspirations, you can make them a reality by managing your cash flow and making smart financial decisions.

One of the most critical aspects of financial management is understanding your company's cash flow to debt ratio.

This ratio measures the company's ability to pay off its short-term debt using its cash flow, which includes investments in inventory and other highly leveraged dollar amounts.

It gives you a clear picture of your financial health and helps you make informed decisions.

By tracking this ratio, you can identify potential financial risks and take the necessary steps to mitigate them.

Fortunately, you can use a calculator to compute your cash debt coverage ratio and determine if your liquidity is sufficient to pay off your debts.

Managing your cash debt coverage ratio may seem daunting, but with the right tools and knowledge, you can take control of your finances.

Start by understanding your cash flow and reducing unnecessary expenses.

You can also maximize your revenue streams by exploring new business opportunities or improving existing ones.

Remember, every small step counts towards achieving your financial goals.

In summary, the ability to pay short-term debts is crucial to financial management, and understanding the cash flow to debt ratio is key.

By monitoring this ratio, you can take proactive steps to paying debt and reducing financial risks.

Managing your finances may require effort, but with determination and hard work, you can achieve your desired success.

So, go ahead and take that first step towards financial freedom today!