This is a complete guide on how to calculate Acid Test Ratio with in-depth interpretation, analysis, and example. You will learn how to use this ratio formula to evaluate a firm's liquidity.

Definition - What is Acid Test Ratio?

A company’s liquidity measured by the current ratio normally depends on how its inventory is converted into cash in a specific time period.

But the inventory is sometimes overstated and subject to several valuation issues. You should also take into account that inventory takes more time to convert into cash than other current assets.

For that reason, financial analysts and investors are keen on using another liquidity ratio that doesn’t rely on inventory. This ratio is called the acid-test ratio, or the quick ratio.

What makes this ratio useful is that it simply takes the inventory value out of a company’s current assets.

In this article, we’ll look into how to calculate this ratio and how to use it as an effective way to measure a company’s liquidity.

More...

Formula

The acid-test ratio is very similar to the current ratio; however, the only exception is that inventory is taken out of current assets.

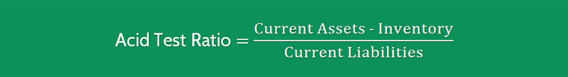

There are a couple of ways to calculate this ratio. However, the most popular equation looks like this:

Acid Test Ratio = (Current Assets - Inventory) / Current Liabilities

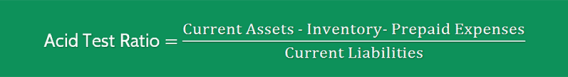

Current assets occasionally contain several minor items, such as prepaid expenses, that hardly become cash, and that’s why they too should be excluded.

A more conservative version of this ratio can be calculated as follows:

Acid Test Ratio = (Current Assets - Inventory - Prepaid Expenses) / Current Liabilities

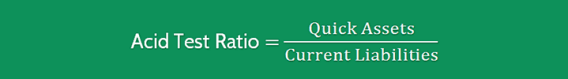

Another formula of this ratio looks like this:

Acid Test Ratio = Quick Assets / Current Liabilities

So how can we find the quick assets? Quick assets normally include cash & cash equivalents, marketable securities, and accounts receivable.

You can easily find all of these numbers reported on a company’s balance sheet.

Example

Okay now let’s consider this example so you can understand clearly how to find this ratio in real life.

Let’s say you are looking to evaluate Company B’s liquidity, or its capacity to repay its short-term debts.

When examining this company’s balance sheet, you found that:

- Current Assets = $250,000

- Inventory = $70,000

- Prepaid Insurance = $15,000

- Current Liabilities = $125,000

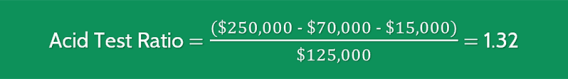

In order to compute this company’s acid-test ratio, we simply use the formula provided above.

We’ll subtract the company’s inventory and prepaid expenses from its current assets, and then divide the result by the current liabilities value, as follows:

As you can see this company’s quick asset ratio is 1.32, and this means that its liquid assets value is higher than its short-term liabilities.

That's to say; the business can easily settle its short-term debts by selling part of its current liquid assets.

Interpretation & Analysis

Now let’s find out how to use this ratio to measure a firm’s liquidity.

A company’s inventory tends to become less liquid because of the following two main reasons:

First, various types of inventory cannot quickly be sold or converted into cash because they are special-purpose or partially completed items.

And second, it’s worth noting that inventories are normally sold on credit; or in other words, they tend to become accounts receivable first before being converted into cash.

Sometimes, companies face issues with their accounts receivable because they cannot collect the money back from their clients.

In such cases, these receivables will turn into bad debts, and this also means that the inventories they sold earlier will never be converted into cash.

When examining a company’s liquid, we want the acid-test ratio to be about 1:1. That’s to say, the company’s liquid assets should be equivalent to its short-term debts.

So what is a good acid test ratio?

A good ratio should be at least 1.5, or in other words, the company’s liquid assets should be 1.5 times higher than its current liabilities.

Cautions & Further Explanation

Similar to other liquidity ratios, the acid-test ratio level that a company should try to achieve depends primarily on the nature of the business in which it’s operating, and the liquidity of inventory also varies from industry to industry.

In general, this ratio provides a more conservative measure of a company’s liquidity only when its inventory cannot be quickly or easily converted into cash.

In case inventory is liquid, you may want to consider using the current assets ratio because it provides a better measure of overall liquidity.