This is an in-depth guide on how to calculate Sales to Fixed Assets Ratio with detailed analysis, interpretation, and example. You will learn how to use its formula to assess a firm’s management efficiency.

Definition - What is Sales to Fixed Assets Ratio?

The sales to fixed assets ratio, also known as the fixed assets turnover ratio, is a performance measurement tool which measures the efficiency with which the company is employing its fixed assets to generate revenue.

This ratio works by comparing a firm’s net sales to its amount of fixed assets, thereby measuring how much revenue has been generated by the company from investments in fixed assets such as plant, property & equipment.

The higher the ratio, the more efficiently the business is using its fixed assets to generate sales revenue.

If a company has a ratio value of 5 times, for example, it means that the company is generating sales of $5 for every dollar of fixed assets held.

On the other hand, a low ratio indicates that the fixed assets of the company does not help generate revenue efficiently.

Different from the total asset turnover ratio, the sales to fixed assets ratio only takes the company’s fixed assets into account, so other current assets such as cash, inventory and accounts receivable must be excluded.

More...

Formula

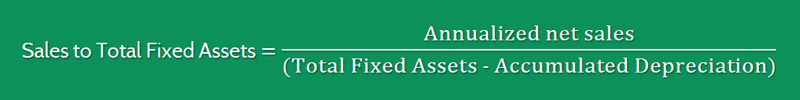

You can use the following formula to calculate the net sales to fixed assets ratio of a business:

Sales to Total Fixed Assets = Annualized net sales / (Total Fixed Assets - Accumulated Depreciation)

A company’s annualized net sales is its amount of sales after deducting sales returns; while total fixed assets are stated at net value.

Net Sales = Sales Revenue - (Sales Returns + Sales Discounts + Sales Allowances)

Fixed assets and accumulated depreciation amount can be found on the company’s balance sheet.

There are circumstances that businesses purchase and sell equipment’s throughout the year, so it’s logical to use average fixed assets in the denominator.

Average Fixed Assets = (Beginning Fixed Assets + Ending Fixed Assets) / 2

So a more precise formula for calculating this ratio looks like this:

Sales to Average Fixed Assets = Annualized net sales / (Average Fixed Assets - Accumulated Depreciation)

You can find all of these numbers reported on a company’s balance sheet and income statement.

Example

Okay now let’s consider a quick example so you can understand clearly how to calculate this ratio.

Company AB is a business that you want to include in your investment portfolio, and you’d like to know whether its management is doing a good job in running the business.

In order to know Company AB’s management efficiency for the past two years, you gathered the following information from its financial statements.

Last Year | This Year | |

|---|---|---|

Annualized net sales | $5,000,000 | $6,000,000 |

Total fixed assets | $1,000,000 | $1,500,000 |

Sales to Fixed Assets Ratio | 5 times | 4 times |

As you can see that last year Company AB had a net sales to fixed assets ratio of 5 times.

This ratio result indicates that this company generated $5 of revenue per $1 of its net investment in fixed assets, which is considered to be a good return.

However, looking at the 2-year performance, the company’s net sales to fixed-assets ratio value reduces from 5 times to 4 times. This indicates that the company either has more fixed assets, or has lower sales.

It’s okay for a business to have more fixed assets; however, in most cases, having less sales is not acceptable.

Interpretation & Analysis

This ratio is mostly useful to investors and creditors in assessing the efficient utilization of fixed assets by the company in generating the revenue.

Investors use this ratio to measure their fair return on investment, and creditors, on the other hand, use this ratio to assess the repayment capacity of the company.

So what is a good sales to fixed assets ratio?

A higher sales to fixed assets ratio indicates that the management is efficiently utilizing fixed assets in generating a larger amount of sales.

But it could also mean that the company has discarded most of its fixed assets due to slow down in business, or it has outsourced its operations.

A lower ratio, on the other hand, suggests that the company is not using its fixed assets efficiently and sales are declining.

This could be an indicator that the product which the company is manufacturing is not in demand and the investment in the fixed assets may not yield positive results.

However, it is also possible that the business is operating in such an industry where product development may take some time to reflect into sales.

Therefore, to use this ratio effectively, you have to take into consideration all the external factors before determining if the ratio is high or low.

Cautions & Further Explanation

A business could be unprofitable, even with an extremely high sales to fixed-assets ratio.

You should always bear in mind that the net sales to fixed asset ratio does not take into account the profit made by a company.

Therefore, you must not use this ratio to directly interpret a company’s profitability like you would when using the net profit ratio.

In addition, you should be aware when using the company’s consolidated balance sheet in case the company that you’re evaluating is operating in different sectors or niches.

That’s because chances are some segments of the company are more capital intensive than others.

Fixed assets vary drastically from company to company due to the fact that they adopt different business models.

Therefore, it’s possible that one company is following an asset-light model while the other is adopting an asset-intensive model, though they are operating in the same industry.

In such cases, comparing these companies on the basis of this ratio may give a misleading picture.

There is no benchmark for the best fit sales to fixed asset ratio, and you have to compare the ratio of the same company over past couple of years to get better evaluation results.

Besides, this ratio is more useful when you use it to make a comparison of different companies in the same industry.