This is a thorough guide on how to calculate Sales to Equity Ratio with in-depth example, analysis, and interpretation. You will learn how to use its formula to evaluate a firm's efficiency.

Definition - What is Sales to Equity Ratio?

The sales to equity ratio is a simple calculation that can help you determine how efficient a company is in utilizing its shareholders’ capital to generate sales.

This ratio is normally used by investors to determine the amount of the company’s capital that should be retained or kept within a business as sales volumes fluctuate.

For instance, if a business wants to rapidly increase its sales, it must allocate a higher amount of working capital to maintain or achieve this higher level of sales growth.

This ratio, in a way, gives you a clearer picture of the relationship between a company’s revenues and its total shareholders’ equity.

An increase in revenues of a company is often accompanied with an increase in its profits.

Additional profits can either be distributed to the shareholders in the form of cash dividends or held by the company in the form of retained earnings. In either way, the company’s equity will be affected.

The net sales to equity ratio can also help you in determining if a company has too much equity which could be utilized to pay extra dividends, perform stock buybacks, or provide benefits to shareholders in other form of distribution.

More...

Formula

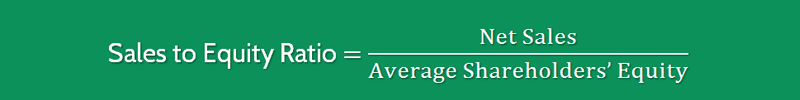

In order to calculate the sales to equity ratio, you can use the following formula:

Sales to Equity Ratio = Net Sales / Average Shareholders’ Equity

To calculate this ratio, we simply divide the company’s net sales by its average shareholders’ equity.

Net sales can be arrived at by subtracting any sales returns from the company’s gross sales, like so:

Net sales = Gross sales – Returns

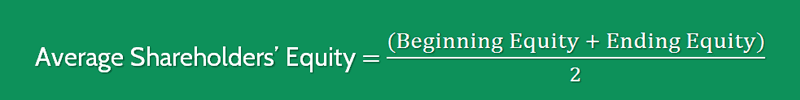

Average shareholders’ equity can be calculated by summing the beginning and ending equity, and then divide the result by 2.

Average Shareholders’ Equity = (Beginning Equity + Ending Equity) / 2

You can easily find all of these numbers reported on a firm’s balance sheet and income statement.

Example

Okay now let’s take a quick example so you can see exactly how this ratio is calculated.

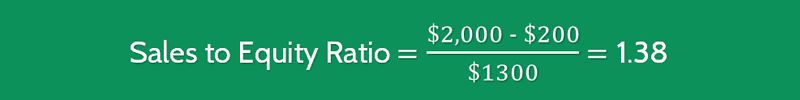

For example, you are investing Company A which did $2,000 in sales. One of its major customers returned $200 worth of goods.

After looking into its balance sheet, you find that this company has $1,300 in total average shareholders’ equity.

By using the above formula, you can easily calculate the sales to total shareholders’ equity ratio of this business, as follows:

As you can see that for every dollar Company A has in total shareholders’ equity, it can generate $1.38 in revenue.

Interpretation & Analysis

A high value of net sales to total equity ratio suggests efficient use of shareholder’s equity and thus better equity management by the firm.

On the other hand, a decreasing trend would require further investigation into the causes.

In general, an increasing ratio is beneficial to the company. Usually an increase in ratio can be achieved by increasing sales.

However, it is also possible that the ratio increases due to a decrease in the total equity.

If a firm is operating in a market with limited avenues for further growth and with access to affordable loans, the firm may decide to reduce equity for the benefit of investors.

Therefore, a change in this ratio needs to be investigated further. It could either be due to a decrease / increase in sales, or due to increase / decrease in shareholders’ equity.

Cautions & Further Explanation

Since this ratio only takes the company’s equity into consideration, there is scope for management to skew this ratio in their favor by employing more debt in the capital structure of the company.

By taking on more debt, the firm will be able to increase this ratio but at the same time will be exposing itself to higher interest expenses.

If the revenues go down, it could lead to serious financial troubles for the business due to high interest payments.

Another factor to keep in mind is that the ratio only takes the revenue figure into account.

It is possible that the picture portrayed by this ratio does not represent the true state of the business as it does not tell us anything about the company’s bottom line (aka net profit) or operating cash flow.

As with most financial ratios, this ratio cannot be used to compare firms across different industries.

The ratio result would vary depending upon how capital intensive the industry is.

For example, a manufacturing business may have a lower ratio as compared to a services business since a firm in the services industry does not need large capital investments.