This is a detailed guide on how to calculate Long Term Debt to Total Assets Ratio with in-depth interpretation, example, and analysis. You will learn how to use its formula to evaluate a firm's ability to pay off its long-term debt.

Definition - What is Long Term Debt to Total Assets Ratio?

The long term debt to total assets ratio tells us what portion of the company’s assets are financed by its non-current liabilities, such as loans and other non-current obligations.

It provides us insights about the current standing of a company’s financial position and its ability to meet its financing needs.

It is one of the many ratios that shed light on the capital structure and leverage levels of a company.

We will see how this ratio can benefit both the firm’s management in optimizing the capital structure and the investors in making an informed decision about investing in the firm.

More...

Formula

In order to find the long term debt to total asset ratio, you can use the following formula:

LT Debt to Total Assets Ratio = Long-term Debt / Total Assets

As you can see that this ratio is calculated by dividing the long term debt of a company by the total value of its assets.

Total assets would include both current and fixed assets, and long-term debt includes all obligations lasting for more than a year such as bond issues and facility leases.

You can easily find all of these numbers on reported a company’s balance sheet.

Example

Okay let’s dive into a quick example so you can see how easy it is to calculate this ratio.

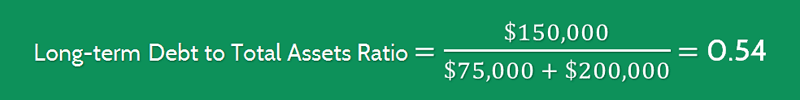

Assume that you’re investing in Company ABC and you’d like to find out how many percentages of its assets are currently financed by loans and other long-term financial obligations.

By looking into the firm’s statement of financial position, you found the following information:

- Total Current Assets = $75,000

- Total Non-current Assets = $200,000

- Long-term Debt = $150,000

Using the given formula, you can easily calculate this company’s long-term debt to total assets ratio, as follows:

The ratio result of 0.54 tells us that for every dollar that the company has in assets, it has 54 cents as long-term debt.

Or in other words, 54% of the company’s assets are currently financed by its long-term liabilities.

Interpretation & Analysis

To draw meaningful insights from the long-term debt to total asset ratio, you will need to look at the ratio of comparable firms and also the historical values of this ratio.

A decrease in this ratio year-on-year represents that the firm is doing well. It means that the firm’s dependence on debt is coming down.

A high value might mean that the company needs higher cash inflow to meet all the expenses (such as interest payments).

A higher value also signifies a higher risk for the business which may make raising money in the future more difficult.

This ratio is very helpful for the management to keep track of the firm’s debt structure and keep it in check.

For investors, this ratio helps in comparing the capital structure of similar firms before making an investment decision.

So what is a good long term debt to total assets ratio?

Ideally you should look for companies with the long term debt to total assets ratio of less than 0.50.

These companies often have less than 50% of its total assets funded by outside lenders, which also means it doesn’t have to rely too much on debt to generate more profits as well as create more assets.

As an investor, obviously you don’t want to invest in companies with a high level of debt, so the lower the ratio, the better.

Cautions & Further Explanation

Before making any comments when using the LT debt to total assets ratio, you should first look at the industry in which the firm is operating.

Similar to other debt ratios, the acceptable value of this ratio varies between industries.

Different industries operate on different levels of leverage, and thus a ratio considered high for one industry might be the norm in the other.

For instance, the manufacturing sector is known to have higher long-term debts. You need to keep these industry specific characteristics in mind before reaching a conclusion.

As you can see that this ratio is very similar to debt to assets ratio.

The only difference is that in long-term debt to assets ratio, we do not include short-term obligations such as rent and other short-term loans.

Depending on the objective of your analysis, you will need to be careful about these small yet significant differences while looking at these debt evaluation ratios.