This is an ultimate guide on how to calculate Investment Turnover Ratio with detailed interpretation, analysis, and example. You will learn how to use this ratio formula to evaluate a company's efficiency.

Definition - What is Investment Turnover Ratio?

The investment turnover ratio helps us measure the ability of a company to generate revenues using the debt and capital that have been invested in the business.

There are two ways a company can raise money to support its operations: it can use both debt financing (i.e. taking a loan) and equity financing (i.e. issuing shares).

This ratio can take these aspects into account, thereby help you determine how well the company is able to convert its shareholders’ equity and debt into dollars of sales.

In general, the higher the investment turnover ratio, the more efficient the company is in generating revenues from its debt and equity capital.

More...

Formula

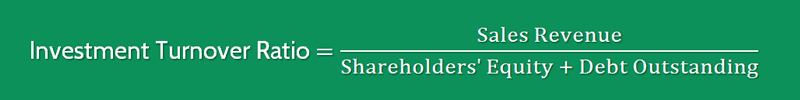

In order to calculate the investment turnover ratio, you can use the following formula:

Investment Turnover Ratio = Sales Revenue / (Shareholders’ Equity + Debt Outstanding)

Debt outstanding includes both long-term debt and short-term debt (such as the current portion of long term debt and short term liabilities).

Debt Outstanding = Long-term Debt + Current Portion of Long-term Debt + Short-term Securities

Shareholders' equity consists of funds raised by issuing common stock and the retained earnings.

You can easily get all of these numbers reported on a company’s income statement and balance sheet.

Example

Okay now let’s consider a quick example so you can see how easy it is to calculate this ratio.

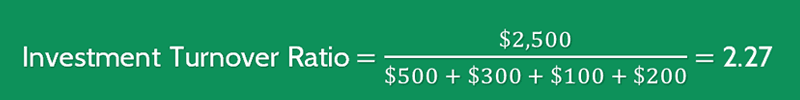

Assume that you are investing in Company A which reports $2,500 in sales revenue, and its shareholders' equity is worth $500.

By looking into this company’s balance sheet, you find that it has $300 in long-term debt, $100 in the current portion of long-term debt, and $200 in short-term securities.

In order to assess how well this company is utilizing its shareholders’ capital and debt to generate sales, you calculate the investment turnover ratio, as follows:

The ratio value of 2.27 indicates that for every one dollar invested in Company A, it can generate $2.27 in revenue.

Interpretation & Analysis

This ratio tells us how efficiently the company is able to use its resources to generate revenues.

So what is a good investment turnover ratio?

Generally speaking, the higher the ratio, the better.

If you are trying to compare multiple firms from an investor’s perspective, a company that has been able to maintain a healthy investment turnover ratio over time has higher chances of outperforming its peers.

A higher ratio means that the company is using its resources more effectively. Better usage of resources will increase value for shareholders.

On the other hand, a lower value compared to its industry peers would mean that the firm’s operation is not as efficient as others.

Cautions & Further Explanation

A company having a higher investment turnover ratio is not necessarily performing better as compared to a firm having a lower ratio.

While dealing with this ratio, we have to be careful about the fact that it does not provide a complete picture of the firm’s income. It’s all about sales and not about profit.

A company having an outstanding investment turnover ratio might actually be in losses.

If you encounter such a situation, you should study the financial statements of the company in detail to figure out the reason behind the observation.

As with most financial ratios, this ratio too cannot be compared across industries.

As we have seen earlier, there are some industries which are very asset intensive and thus need a large investment.

On the other hand, there are some industries that hardly need any fixed assets, and thus fewer funds may be required to generate the same sales revenue.

Therefore, it will not provide valuable insights if we use this ratio to compare two companies that are not operating in the same industry.