This is an ultimate guide on how to calculate Fixed Charge Coverage Ratio with thorough analysis, example, and explanation. You will learn how to use its formula to evaluate a company's solvency.

Definition - What is Fixed Charge Coverage Ratio?

The fixed charge coverage ratio is a useful solvency ratio that tells us about the capability of the firm to repay its fixed charges when they become due.

To understand the importance of this ratio, let us first look at what fixed charges could be.

A fixed charge can be any recurring expense such as mortgage payments, insurance, salaries, etc. To remain in business, a firm needs to be able to meet these expenses.

This ratio is especially important for firms with long equipment leases. Lease payments can be found on the balance sheet of a company (usually found in the footnotes).

The ratio tells us how many times can the company meet its fixed expenses per year.

More...

Formula

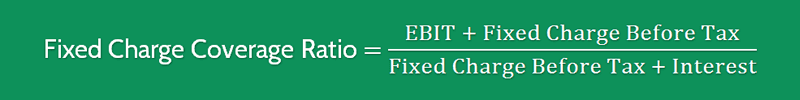

Now that we have understood what fixed charges are, let us look at the formula to calculate fixed charge coverage ratio.

Fixed Charge Coverage Ratio = (EBIT + Fixed Charge Before Tax) / (Fixed Charge Before Tax + Interest)

We add all the fixed costs of a firm under the head “fixed charge before tax” in the formula above. It might take some judgment to decide whether certain costs are fixed or not.

You need to dig deeper and figure out if they truly are recurring fixed costs for the firm, such as a one-time payment can be excluded from the calculations.

Example

Okay now let’s consider a quick example so you can see exactly how to calculate this ratio.

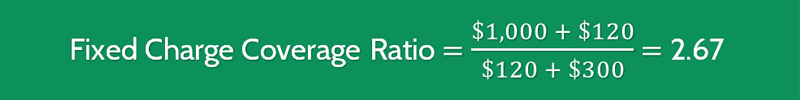

Firm A has $1,000 of income before interest and taxes (EBIT) and interest expense of $300. Its current lease payment is $10 per month.

- EBIT = $1,000

- Interest Expense = $300

- Lease Payment per year (Fixed cost) = $10 x 12 = $120

The above value means that company’s income is 2.67 times its fixed costs. Higher value means that a business is healthy.

In case the firm has other fixed costs such as insurance and utilities, all of those will be added to the head "Fixed charge before tax" before substituting the value in this formula.

Interpretation & Analysis

This ratio provides a basic idea about the company’s finances. Often a bank would look at this ratio (along with other ratios) before approving a loan for any business.

So what is a good fixed charge coverage ratio?

A fixed charge coverage of 2.0 or higher is considered a good ratio, because it depicts that the business income 2 times higher than its current fixed charges.

A ratio marginally over 1 signifies that although the business will be able to cover its fixed costs, it does not have a large cushion.

On the other hand, a low value of less than 1.0 indicates weak finances.

In such situation, even a small decrease in sales would put the firm in a spot of bother. It might force it to lower its prices to make sure that revenues do not fall in the short run.

Cautions & Further Explanation

Although we saw above that a higher fixed charge coverage ratio is better, we have to be careful while drawing any insights from it.

Too high a ratio value might indicate that the firm is not utilizing leverage to its maximum potential. It would depend upon various factors including the industry that the business is operating in.

As touched upon earlier, you have to use your judgment while deciding which costs to include under fixed costs.

Going through the financial statements and keeping the purpose of calculating the ratio in mind will help you in deciding it.

As always, this ratio should be one of the many ratios that you look at to know more about a company's current financial situation.