This is a complete guide on how to calculate Accounts Receivable Turnover (A/R) ratio with detailed example, interpretation, and analysis. You will learn how to use its formula to evaluate a firm's efficiency.

Definition - What is Accounts Receivable Turnover?

An efficiency ratio measures how well a company uses its assets to generate income.

As one measure of this efficiency, the accounts receivable turnover ratio, which is often known as debtors turnover ratio, allows you to calculate how often a business collects its outstanding customer payments on an annual basis.

This is important information to acquire when you’re analyzing a potential investment because a company’s accounts receivable (AR) do not become usable cash until they’ve been collected from clients.

If a business is not very efficient at converting its outstanding credit sales into cash on a regular basis, it may appear asset-rich, but a large portion of its assets won’t be very liquid.

Efficiency and liquidity both play integral roles in determining whether a firm will have the money to pay its bills on time and the means to consistently support its regular business operations, without additional funding.

More...

Formula

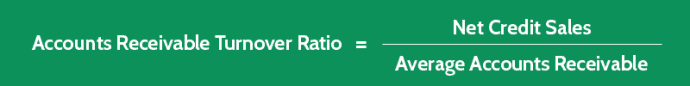

Before we learn how to find the receivables turnover ratio, let's have a look at its formula.

The accounts receivable ratio is calculated by using the following formula:

A/R Turnover Ratio = Net Credit Sales / Average Accounts Receivable

In this ratio, the term ‘net credit sales’ refers to a firm’s total sales amount for the year, less any refunds or returns.

Note that you’ll only be including those sales that involved credit, rather than cash, since a company’s accounts receivable amount consists solely of customer payments that are outstanding, and have not yet been collected.

Because the value of a company’s receivables fluctuates regularly as amounts owed are collected, you can average the accounts receivable amounts from the first and last months of any reporting year to arrive at an average accounts receivable figure.

Read also: Total Asset Turnover Ratio - Formula, Example & Analysis

Accounts Receivable Turnover Calculator

Example

Now let's take a look at the following receivables turnover ratio example so you can understand exactly how to use this ratio to evaluate a company's efficiency.

If you wanted to evaluate the A/R turnover ratio of Company Z as part of your investment analysis, you might turn to its financial statements from the past year and discover the following figures:

- Gross Credit Sales = $5,000,000

- Opening Accounts Receivable (AR) = $1,400,000

- Sales Returns = $200,000

- Closing Accounts Receivable (AR) = $1,000,000

Using these figures and the AR formula given above, you could easily find account receivable turnover ratio of Company Z for the year, as follows:

(with Net credit sales = Gross credit sales - Sales returns)

Interpretation & Analysis

Okay now let's see how the accounts receivable turnover is used to analyze a company's efficiency.

so what does accounts receivable turnover mean?

The higher a firm’s AR turnover ratio is, the more efficient it is at collecting its customer receivables.

This means that it’s better at converting its outstanding credit sales into cash more frequently throughout the year.

If an organization’s AR turnover ratio is 4, as in the example of Company Z, it means it collects its average accounts receivable amount four times a year, or about every 90 days.

So what does the accounts receivable turnover ratio measure?

The more efficient a company is at collecting its receivables, the more positive its cash flow situation, and the more capable it will be of meeting its financial obligations.

A higher A/R turnover ratio also demonstrates that, since a business is more likely to collect on its debts in a timely manner, it makes a better candidate for borrowing funds.

Efficient operations and a quality credit rating are both desirable attributes of any company you may be considering as an investment.

Cautions & Further Explanation

One important note regarding the evaluation of a firm’s A/R turnover ratio is that the formula outlined here describes a manual calculation.

If you use accounting software to calculate your financial ratios, you should know that many programs use a different formula to arrive at the receivables turnover.

These alternate formulas can significantly affect the ratio result because they weight every receivable equally, and then calculate the number of days each has been outstanding.

This means that even the smallest amount owing can effectively skew the receivable turnover ratio outcome, if it’s been outstanding for a relatively long period of time.