A sinking fund is a special fund established by a bond-issuing entity where it deposits regular contributions for the exclusive purpose of buying back some of the bonds.

Money put into the sinking fund is invested to increase the value of the fund.

The fund will also grow from additional deposits made by the issuer.

A sinking fund normally compels the issuer to retire portions of the bonds on a staggered basis so that all the issued bonds are fully redeemed at the date of maturity.

Establishing a sinking fund to finance the bonds becomes mandatory on the part of the issuer if it is embodied in the bond instrument through a sinking fund provision.

In the absence of this contractual clause in the bond indenture, corporations need not to set up a sinking fund.

Benefits of Sinking Funds

There are, however, distinct advantages in having a sinking fund as part of bond issuance.

On the part of the issuer, it ensures that there will be enough money to redeem the bonds.

For investors, the bonds will look less risky to them. We can safely state that the general effect of a sinking fund is to increase the marketability of the bonds.

Drawbacks of Sink Funds

The organization normally exercises its right to repurchase or call on issued bonds if interest rates drop and bond prices go up since it can purchase the bonds below market price.

For this reason, callable bonds typically carry higher rates as a way of balancing the issuer’s option to repurchase issued bonds at lower market rates.

Sinking Fund Formula

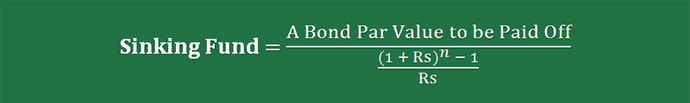

You can use a sinking fund formula to calculate the amount of regular or periodic contributions that go into a particular sinking fund.

Through the use of this method, the issuer of the bonds can suitably prepare its assets in redeeming the bonds upon their maturity.

The formula looks like this:

Rs represents the rate of return or increased in value of the money contributed to the sinking fund.

Example

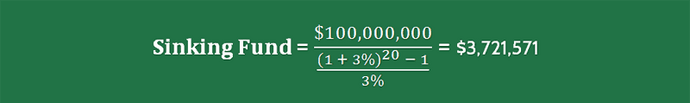

To see how the formula works, let’s consider a hypothetical scenario involving a bond issuer.

For example, Entity A issued 1 million bonds with a par value of $100 each and a coupon rate of 5%.

The bonds will come to maturity in 10 years, and entity A is required to establish a sinking fund provision to pay off the issued bonds.

Assume that semi-annual payments will be made to the fund, and the rate of return on this fund is 6% per annum.

In this example, the future value of the bond will be $100 million and the interest rate will be 3.0% since payments are made twice a year. The total period is of course 20 (2 x 10).

Applying the formula above, we will arrive at this equation:

Based on our computation, the issuer has to deposit $3,721,571 every six months for ten years to the sinking fund to save enough money to finance the redemption of the bonds when they mature.