Are you a business owner or entrepreneur who wants to ensure your company's financial stability?

If so, you've come to the right place!

In this blog post, we'll be discussing an important financial metric known as the cash flow adequacy ratio.

You may have heard of this term before, but do you fully understand what it means and how it can benefit your business?

The cash flow adequacy ratio is a crucial tool that helps you measure your company's ability to generate enough cash flow to cover your expenses.

Essentially, it assesses whether the company has sufficient cash flow to pay its bills.

By using a cash flow adequacy ratio calculator, you can calculate this metric and identify potential cash flow issues before they become major problems.

This enables you to plan and budget effectively, ensuring your business remains financially stable and operational.

But that's not all!

The cash flow adequacy ratio can also help you make informed business decisions, such as whether to invest in new projects or expand your operations.

By understanding your cash flow, you can make strategic decisions that will drive growth and increase profitability.

It's important to note that the cash flow adequacy ratio is a liquidity ratio and measures the ability of a company to pay its bills on time.

This is different from the flow of cash from operations, which is the amount of cash generated by a company's core business activities.

Ideally, you want a cash flow adequacy ratio of 1 or greater, which means the company is generating enough cash flow to cover its expenses.

A cash flow adequacy ratio of less than 1 indicates that the company may struggle to pay its bills.

The cash flow adequacy ratio is a metric that helps businesses measure their ability to generate enough cash flow to cover their expenses.

By using this metric, you can identify potential cash flow issues and make informed business decisions that will drive growth and increase profitability.

In the following sections, we'll explain how to calculate the ratio and provide some real-world examples of businesses that have benefited from mastering this important financial metric.

So, let's dive into the exciting world of the cash flow adequacy ratio!

Definition - What is Cash Flow Adequacy Ratio?

The cash flow adequacy ratio is a valuation ratio used to determine a company's financial health and solvency.

It is an important tool for investors to evaluate a company's ability to meet its financial obligations.

This ratio is particularly crucial for companies that have large capital expenditures or regularly distribute dividends to shareholders.

To calculate the cash flow adequacy ratio, a company's cash inflows are compared to its cash outflows.

Cash outflows include ongoing expenses such as salaries, rent, and utilities, as well as capital expenditures and dividend payments.

This ratio provides insight into whether the company generates enough cash from its operations to cover these expenses.

A company that has a cash flow adequacy ratio of 1 or above is generally considered financially stable and capable of meeting its financial obligations.

This means that the company has enough cash on hand to cover its expenses and can continue to operate and grow its business without facing liquidity problems.

On the other hand, if a company has a cash flow adequacy ratio of less than 1, it might indicate that the company is unable to generate enough cash to meet its ongoing expenses.

This could potentially lead to liquidity problems, which could negatively impact the company's future growth prospects.

Moreover, a decreasing cash flow adequacy ratio might indicate that the company is experiencing financial difficulties or facing challenges in generating cash from its operations.

This could be a warning sign for investors, indicating that the company's future performance could be at risk.

To meet its cash outflow, a company must generate enough cash to do so, and this refers to the cash generated from its operations.

It is essential to compare a company's cash flow adequacy ratio to that of its competitors to gain a better understanding of its financial health.

This comparison provides valuable insight into how the company is performing relative to its peers and helps investors make informed decisions about whether to invest in the company.

Overall, the cash flow adequacy ratio is a critical measure of a company's solvency and should be carefully considered by investors when evaluating potential investment opportunities.

Capital expenditure is a significant factor to consider in this regard as it impacts the company's ability to generate enough cash to meet its cash outflow.

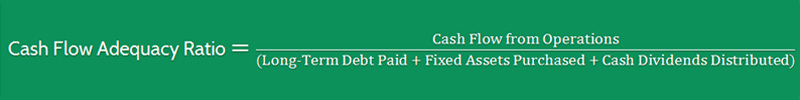

Formula

The formula to measure the cash flow adequacy ratio is as follows:

Cash Flow Adequacy Ratio = Cash Flow from Operations / (Long-Term Debt Paid + Fixed Assets Purchased + Cash Dividends Distributed)

You can find these numbers on a company’s financial statements.

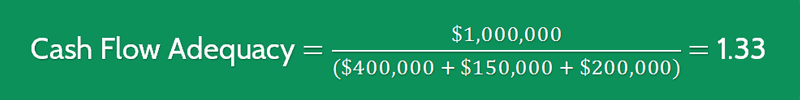

Example

ZYX Company has generated $1,000,000 in cash flows from its operations. It has also acquired $150,000 in fixed assets, paid $400,000 in debt and paid $200,000 in dividends.

To determine the cash flow adequacy we need to substitute into the formula:

ZYX Company’s ratio is 1.33 which is in line with what we would be looking for in order to make the assumption that the business has sufficient cash to pay its ongoing expenses.

Interpretation & Analysis

To assess the financial health of ZYX Company, it is essential to monitor the cash flow adequacy of the business.

One ratio that should be used for this purpose is the ratio of cash generated from operational cash flows to the expenses incurred by the company.

If this ratio is less than one, it means that the company is not generating enough cash to support its expenses from operational cash flows.

Therefore, it may have to rely on credit or also include any extra cash from investing and financing activities to cover its obligations.

To calculate the cash flow adequacy of ZYX, it is necessary to analyze the cash flow statement, which shows the inflows and outflows of cash from different sources.

By comparing the cash generated from operational activities with the expenses, one can determine whether the company is generating enough cash to cover its obligations.

If the ratio of cash generated from operational activities to expenses is increasing over time, it indicates that the company is generating enough cash to support its expenses and financial obligations.

This could lead to a positive credit rating and provide a positive indicator of the future performance of the business.

However, if the ratio of cash generated from operational activities to expenses is decreasing over time, it could be a warning flag to potential investors that the trend may continue.

This would provide uncertainty over the future capabilities of ZYX Company in covering its future obligations.

In such cases, the company may need to rely on credit or also include any extra cash from investing and financing activities to cover its obligations.

Therefore, it is crucial to monitor the cash flow adequacy of the company regularly to make informed investment decisions.

Cautions & Further Explanation

The liquidity ratio that measures a company's ability to meet its cash expenses is known as the adequacy ratio.

This ratio measures the company's ability to utilize its operations to pay off its net cash expenses.

However, on its own, this ratio provides little insight into the full performance of a company.

It does not include factors that would have a significant effect on the future of a business, such as its working capital or the acquisition of fixed assets.

As an investor, it's important to be aware of these limitations and conduct a comprehensive financial ratio analysis of all areas of the business before deciding whether to invest.

This includes analyzing the company's net income, its cash flow, and how it plans to use its net cash to improve its operations.

The adequacy ratio is commonly used in conjunction with other financial ratios to provide a more complete picture of a company's financial health.

While the adequacy ratio is a useful liquidity ratio that measures a company's ability to meet its cash expenses, it should not be the sole factor used in making investment decisions.

A thorough analysis of all financial aspects of the business, including net income and the acquisition of fixed assets, is necessary to make informed investment decisions.

Frequently Asked Questions

Q: What is a cash flow adequacy ratio, and why is it important?

A cash flow adequacy ratio is a financial metric that measures the ability of a company to generate cash flow from its operations and investments to cover its financial obligations, such as debt payments and capital expenditures. It's important because it helps investors and analysts assess a company's financial health and ability to meet its financial obligations over time.

Q: How is the cash flow adequacy ratio calculated?

The cash flow adequacy ratio is calculated by dividing a company's cash flow from operations and investments by its financial obligations, such as debt payments and capital expenditures. The resulting ratio provides insight into a company's ability to generate enough cash flow to cover its financial obligations.

Q: What does a high or low cash flow adequacy ratio mean?

A high cash flow adequacy ratio indicates that a company is generating enough cash flow to cover its financial obligations, while a low ratio suggests that a company may have difficulty meeting its financial obligations. A company with a high ratio is typically viewed as financially healthy and less risky, while a company with a low ratio may be viewed as financially challenged and riskier.

Q: What are some factors that can affect a company's cash flow adequacy ratio?

Several factors can impact a company's cash flow adequacy ratio, including changes in revenue and expenses, investment decisions, debt payments, and capital expenditures. A company that invests heavily in growth may have a lower cash flow adequacy ratio, while a company that prioritizes debt reduction may have a higher ratio. Additionally, changes in economic conditions and industry trends can also impact a company's cash flow adequacy ratio.

Wrap-Up

Congratulations on completing the journey of exploring the cash flow adequacy ratio.

It's crucial to understand the importance of this financial metric for assessing the financial health of your business.

Imagine your company generating enough cash to cover all operational costs and invest in growth opportunities without worrying about running out of cash.

This is the ultimate goal, and achieving it requires a balance between your inflows and outflows, which can be determined through the cash flow adequacy ratio.

The cash flow adequacy ratio measures the ability of a company to meet its financial obligations, including paying off debts, managing expenses, and investing in future growth.

It is a liquidity ratio that is used to calculate the ratio between the cash that the company makes from its operations and its total cash outflows.

The ideal ratio is greater than one, indicating that the company has more cash coming in than going out.

Monitoring the cash flow adequacy ratio is crucial for the long-term success of your business.

It helps you make smart financial decisions, keep a close eye on your finances, and take your business to new heights.

Investors can also monitor the cash flow adequacy ratios of a company to determine whether it is a good investment.

Analyzing your company's cash flow and maintaining a healthy balance between your inflows and outflows is key to ensuring that your business is financially stable.

Use the cash flow adequacy ratio to assess your company's ability to meet its financial obligations, pay off debts, manage expenses, and invest in future growth.

Keep learning, keep practicing, and keep winning with cash flow adequacy.